Weekly Economic Update 11-21-25: Home Builder Confidence; Building Permits & Housing Starts; Existing Home Sales; and September Employment

Feels good to have data again!

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Earlier this year, when the President began his somewhat unorthodox and often haphazard implementation of a tariff policy, I made the argument that, despite all the reporting to the contrary, tariffs are not inherently inflationary. This has been a staple of my public presentations all year, and is one of the ideas on which I get the most push-back.

Well, last week I got some support for this position from an unlikely source. The Federal Reserve Bank of San Fransico released a white paper that examined 150 years of tariff policy, both in the U.S. and abroad, to determine the “aggregate short-run effects of tariff shocks on inflation and economic activity.” What they found was that, going back to 1870, “a tariff hike lowers CPI inflation.” They go on to point out that:

“the results also hold for the modern post World War II sample period. While the results are more uncertain (which is expected given the much smaller variance of tariff changes since 1945), the point estimates remains statistically significant and continue to point in the same direction: higher tariffs lead to…lower inflation in the short-run.”

The news isn’t all good. They also point out that tariffs lead to lower economic activity and higher unemployment, which is not surprising as moving away from free trade introduces inefficiency in the market. To be clear, if you have been reading my posts, I haven’t been generally supporting tariffs, only pointing out that they are not inherently inflationary, and in that, it seems, I have been proven correct.

Home Builder Confidence

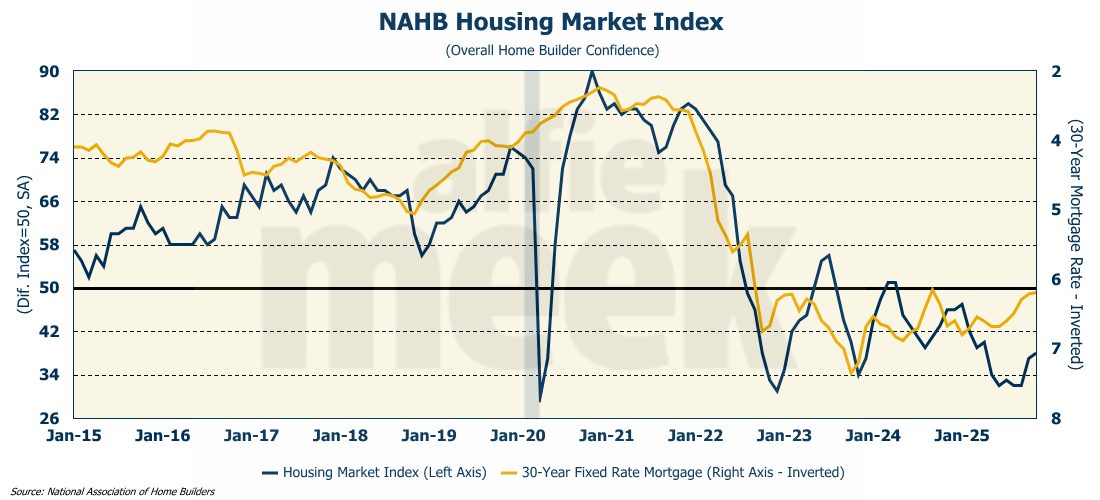

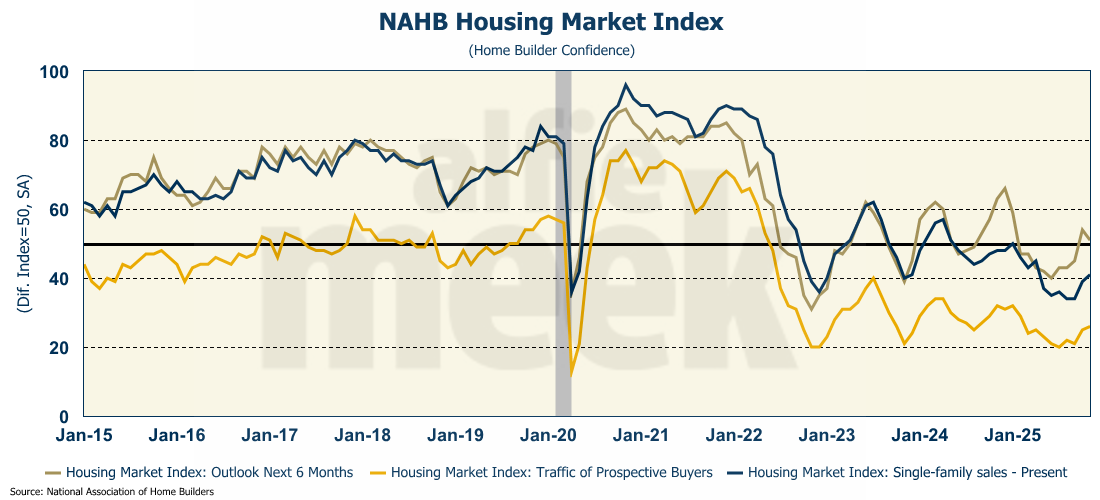

Home builder confidence moved up just 1 point in November as interest rates haven’t moved, and a record share of builders (41%) reported cutting prices to attract buyers (full release here).

Two of the three sub-indicators improved in November - “traffic of prospective buyers” moved up one point, and “single-family sales” moved up two points. However, builders turned pessimistic on the 6-month outlook as that index fell three points and is quite close to moving into negative territory. Remember that this is a “diffusion” index, which means that a reading above 50 is an indication that the majority of builders feel confident about the current and near-term outlook for housing, while a reading below 50 means that a majority of builders are not optimistic.

Building Permits & Housing Starts

Well… both building permits and housing starts were supposed to be released on Wednesday morning. They were not. The release is a lingering victim of the government shutdown and will hopefully be available in the near future.

Existing Home Sales

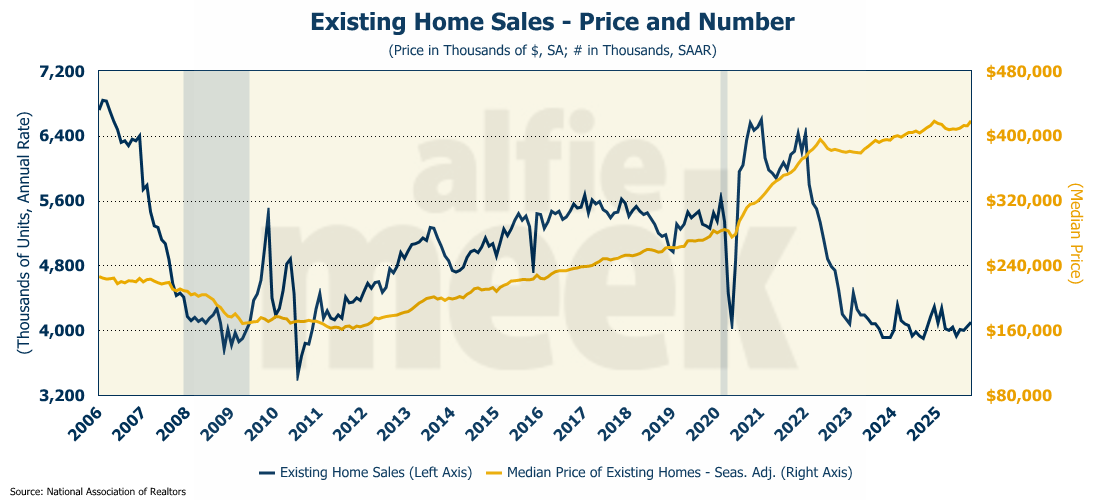

The National Association of Realtors released data on existing home sales for October, and they performed exactly as expected, rising 1.2% for the month and 1.7% over last year (full release here).

The increase lifted the annual rate to 4.1 million units, the highest level in eight months. Even so, 2025 is shaping up to be even worse than 2024, which was itself the worst year for existing home sales since 1995. Despite the sluggish sales, the median price hit an all-time record, rising to $418,668 on a seasonally adjusted basis, which is 2.8% higher than one year ago.

September Employment

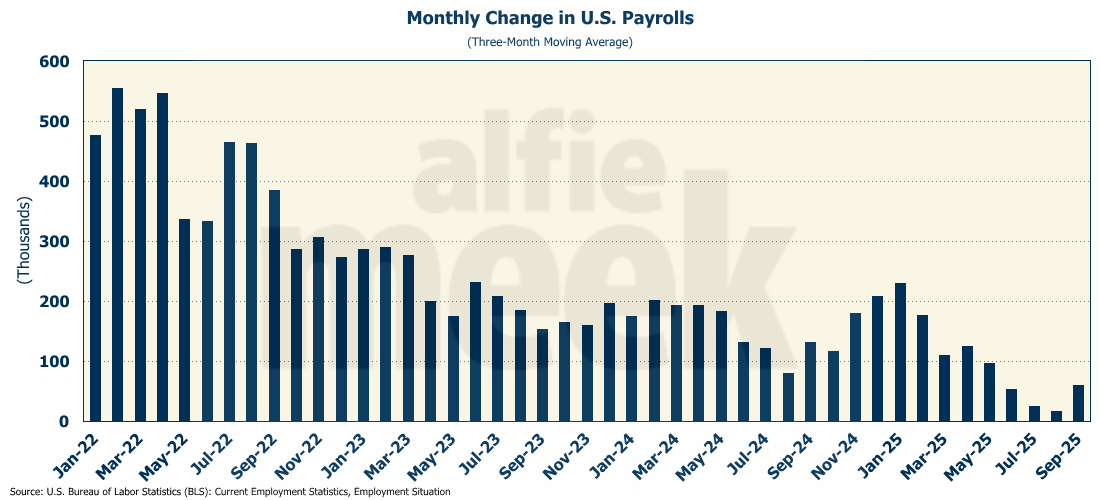

Finally, this week, like a fresh drink of water in the desert of data, we finally got the numbers on September employment, and they surprised to the upside, rising 119K, the largest monthly gain since April (full release here).

And in a surprise to absolutely no one, the August number was revised down to NEGATIVE 4K. That means that in two of the last four months (June and August), the U.S. economy actually lost jobs. Longtime readers know that these consistently negative revisions are why I prefer to view the establishment employment data on a three-month moving average basis. However, even on a three-month moving average, the September reading (as it currently stands) was large enough to buck the downward trend that has been in place since April.

Despite the overall employment growth, manufacturing lost 6K jobs in September, the fifth consecutive monthly decline, and the seventh monthly decline in the past year.

Also, despite the increase in establishment employment, the household survey showed an increase in the unemployment rate to 4.4% - the highest in four years.

Not surprisingly, since the November election, the change in employment among native-born vs. foreign-born employees has changed dramatically. For the 12 moths prior to the election, native-born employment was down 1.1 million, which foreign-born employment was up more than 400K. However, over the past 12 months, those numbers have switched dramatically, and native-born employment is up 2.5 million while foreign-born employment has fallen 670K.

It is very possible we will never get the October employment numbers, which will cause a void in the data that analysts like me will be dealing with forever. The BLS has announced that the November numbers will be released in mid-December. So we are still some time away from getting caught up with the U.S. employment picture.

One More Thing…

I want to wish everyone a Happy Thanksgiving! As you spend time next week with family and friends, remember to be thankful for all with which you have been blessed. Parts of the economy may be struggling, and there are some gray clouds on the horizon, but we are still very fortunate, and I hope that we will all keep that in mind - not just next Thursday, but every day.

A reminder that in a few weeks, I will be turning off all recurring charges for monthly, bronze, and silver members on the Buy Me A Coffee site and making the move to paid subscriptions on SubStack. If you want to continue receiving the full update uninterrupted, please make a pledge on that site and when I turn it on in January, the charge will go through.

For those few who have committed to monthly contributions on the Buy Me A Coffee site of less than $8/month, your charge and subscription will also end in early December. You will need to jump up to $8 on SubStack to keep getting the update in the new year.

And, once again, let me remind many of you who may have already made a pledge, but did it one or more years ago, that it will go into effect when I turn on paid subscriptions, so please make sure you still want to subscribe at that level.

If you want to offer one-time support, you can still click/scan the QR code below.