Weekly Economic Update 2-07-25: Factory Orders; ISM Manufacturing & Services; JOLTS; and January Employment

The manufacturing outlook is positive, but services slowed as the labor data undergoes major revisions.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

First, let me say “thank you.” Thank you to all those who supported this effort last week. We had several people buy one or more coffees, and we also added some new monthly members. Some people made their coffee purchases “recurring” so they will be automatically supporting this effort every month.

But even more than the financial support, thank you for the comments. Several of you left encouraging notes with your contribution. Just a few examples…

Thanks for your efforts. Your weekly updates help me plan for my business and make better decisions as a local elected official.

In spite of a jumble of media "noise", Alfie's newsletter puts things into perspective in a highly readable, concise way.

I enjoy your thoughts & commentary enough to subscribe to your message. Keep it up!

Love you! Thanks for writing this each week!

OK, that last one was from my sister, but you get the idea. Given all the effort that goes into this each week, these notes are a huge source of encouragement. Thanks again to all of you!

So, the big news this week? Tariffs. And then, by Monday afternoon…no tariffs. After initially threatening retaliation, both Mexican President Sheinbaum and Canadian Prime Minister Trudeau folded like a cheap tent once they realized that a trade war with the world’s largest consumer market would hurt their economies much more than it would hurt ours. And that was the point of the tariffs all along…leverage. We have it. They don’t. You would have thought that they would have learned the lesson by watching Columbian President Petro make the same miscalculation two weeks ago. It only took him 6 minutes to come to this realization. It took Sheinbaum and Tredeau 48 hours. But alas…sometimes, like a young child, you just have to touch the stove to realize that it will burn you.

As with the Fed last week, the President is playing 3D chess, while everyone else, including apparently the editorial board of the Wall Street Journal, is playing checkers. First, these tariffs were never going to go into effect. They were leverage. Sometimes, you have to say crazy things like “50% tariffs” or “we’re going to own the Gaza strip” to reframe the issue and establish your leverage. Second, even if they did go into effect, despite what you will hear most everywhere else, tariffs are NOT inherently inflationary. They could be, but the extent to which consumers would face higher prices depends on a variety of economic factors. Further, if you look at the historical record, tariffs have not routinely resulted in inflation. A few examples…

The Tariff Act of 1828 (aka “Tariff of Abominations”) were the highest tariffs ever enacted by the U.S., and hurt the economy of the south so badly that it escalated the threat of a civil war and led to the Nullification Crisis of 1833. Even so, according to the Federal Reserve, inflation from 1829 through 1833 was either flat or negative. In fact, inflation didn’t return until 1834, the year after the law was partially repealed.

The Tariff Act of 1890 (aka the McKinley Tariff) was one of the highest tariff acts in U.S. history raising the average duty on imports to almost 50%. Again, according to the Federal Reserve, inflation in 1891, 1892, and 1893 was 0.0%.

The Tariff Act of 1930, (aka the Smoot-Hawley Tariff…made famous by Ben Stein in Ferris Beuller’s Day Off) was the second highest in United States history, exceeded by only the Tariff Act of 1828. Granted, this was a bad idea on several levels as it unquestionably made the Great Depression worse. But while it was a lot of things, it was most definitely NOT inflationary with inflation averaging -5.2% over the next 4 years.

Don’t get me wrong…tariffs often have negative economic consequences, but inflation is not necessarily one of them. All these economists who cry “INFLATION” every time the word “tariff” is mentioned are crying “wolf.” Interestingly, most of those same economists don’t seem to mind it when the Fed prematurely lowers interest rates, which is the real inflationary threat. Go figure.

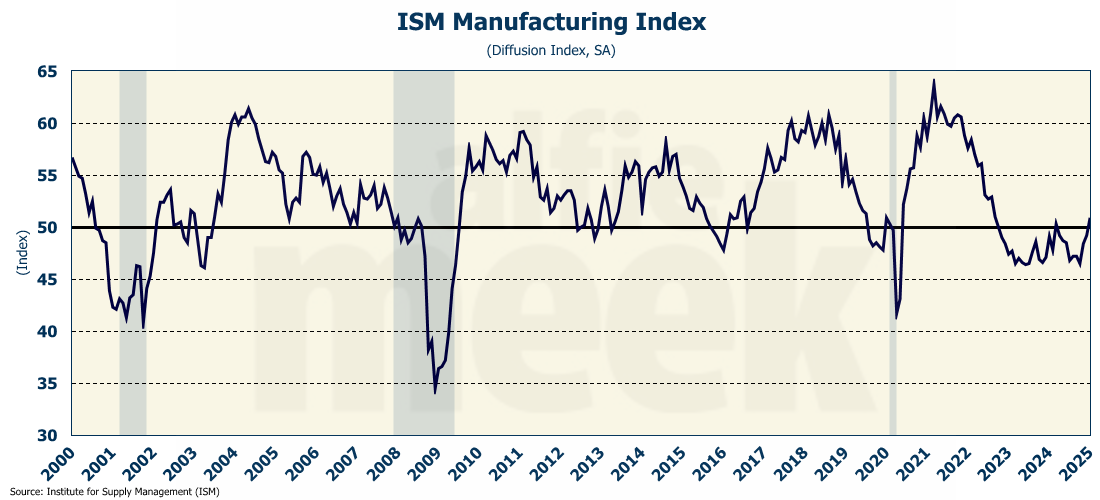

ISM Manufacturing

Well, what do we have here? The ISM Manufacturing index has moved above 50 for only the second time in the last 27 months (full release here). As a reminder, any reading above 50 means the sector is expanding, and a reading below 50 means it is contracting. For over two years, manufacturing has been in recession. But, two weeks ago, I pointed out that the manufacturing sector was showing signs of life with capacity utilization increasing and business leaders in the manufacturing sector reporting a positive outlook.

Looking at the sub-indices, it appears that even the employment index is above 50 for the first time since May, and new orders are above 50 for the second consecutive month. Unfortunately, the prices paid are also above 50 (as they have been for most of the year) and increased from last month. Inflationary pressure is still lurking in the manufacturing sector.

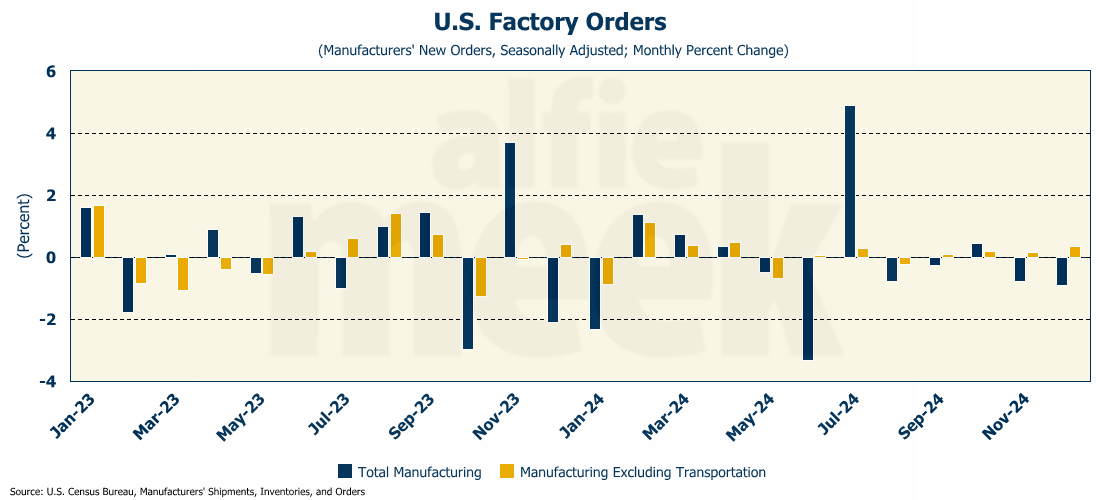

Factory Orders

All these surveys of manufacturers are great…the ISM Purchasing Managers Survey, the Philadelphia Fed Manufacturing Business Outlook Survey, etc., but they are a reflection of “feelings.” Educated, well-informed feelings, but feelings none-the-less. The “hard” manufacturing data has yet to reflect those feelings. For the second consecutive month, actual orders placed with U.S. factories were down (full release here). On the positive side, if you exclude transportation orders (which tend to be very volatile) orders were up slightly for the third month in a row.

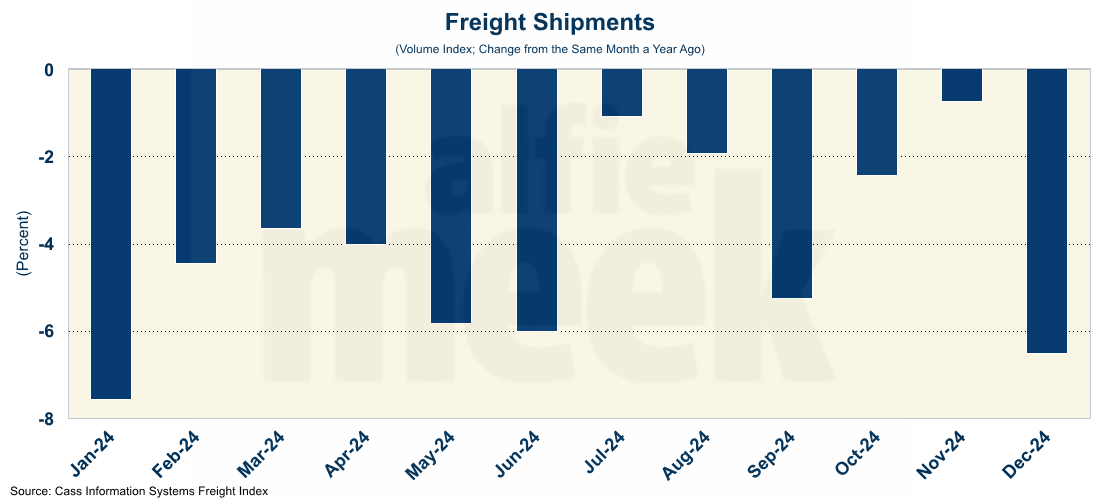

On an annual basis, that left total orders in 2024 down 1.5% from 2023. Again, however, if you exclude transportation, total orders were actually up 1.4% for the year over 2023. The problem, of course, is that inflation was running hotter than that so in real terms, manufacturing orders were way down…with or without transportation. And those numbers shouldn’t surprise us. If you look at the volume of freight shipments for 2024, it was down on a year-over-year basis every single month in 2024.

ISM Services

While the manufacturing sector seems to be improving, the services sector slowed in January, according to the ISM Services report (full release here). That said, the index is still above 50, as it has been since July, which means that the service sector continues to expand.

Services employment is also above 50 and actually improved in January. Unfortunately, inflation remains hot, but it did decline in January. The largest concern in the report was the sharp drop-off in new orders, which fell more than 3 points and is at risk of falling below 50.

Most of the decline in services was attributed to the weather. However, since the election, manufacturing indices have been improving and service indices have weakened. It will be interesting to see if this trend continues, or if it really is a weather phenomena.

Job Openings and Labor Turnover Survey (JOLTS)

In December, job openings tumbled by 556,000, going from 8.156 million to just 7.600 million - the second lowest print since the COVID crash (full release here). Looking at the individual sectors, “professional and business services” fell by 225,000, which was a reversal from the addition of 273,000 in November. Healthcare and social assistance also fell significantly (-180,000), as did finance and insurance (-136,000).

Job openings in the construction sector continue the collapse that started in early 2024. What is interesting, as I have pointed out many times here, is that construction employment has yet to reflect that move.

We are still in a situation where we have more job openings than jobs, but the gap is closing and is now at only 714,000.

January Employment

That leads us to the final data point of the week, the January employment report. What a complete mess. The historical revisions were substantial. Given that I need to get this out just hours after the release, I am going to need time to digest the data and won’t be able to comment on everything today. In short, the economy added 143,000 jobs in January, and the unemployment rate fell slightly to 4% (full release here).

On a three-month moving average basis, employment is clearly trending up and is now running at 237,000. That is much higher than the January number of 143,000. This is because in total, November and December were revised UP by 100,000 jobs.

However, while growth appears to be strong, as has been the case for quite some time, most of the job growth in January (69%) was in healthcare and government. Over the past 6 months, job growth in “primary” sectors (e.g., manufacturing, finance, information technology, professional services) has been flat. Absolutely no growth. Conversely, secondary sectors (e.g., retail, healthcare, hospitality, transportation) have grown 1.1% over the past 6 months, and government employment has grown 0.8%. So, while the overall employment growth looks good, the growth has been in low-wage, secondary sectors and not in those sectors that actually grow the economy.

One More Thing…

I want to thank Warren Averett for the opportunity to speak at their Business Edge Lunch this week. I presented an economic update and my economic outlook for 2025. It was a great group and, as always, I enjoyed the opportunity to talk about the economy and where I see it going. I hope they enjoyed it as much as I did.

In the first post of the month, I try to recognize my gold and silver members. Special thanks to my only “gold” level member Andrew Hajduk and to my two “silver” level members Dan McRae and C. Fitch. Their support helps cover the costs associated with putting this together each week.

If you are a regular reader and find this useful, please consider a membership. I invite you to click/scan the QR code below to join or just “buy a coffee!”