Weekly Economic Update 05-16-25: Small Business Optimism; CPI; PPI; Retail Sales; Home Builder Confidence; and Building Permits & Housing Starts

Apartment construction continues to rise because no one can afford their own home.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

This was probably the busiest week I have had in a long time. From Tuesday around noon until Thursday night, I was driving for a total of 20 hours and 1,000 miles all over Alabama, Georgia, and South Carolina. And that left almost no time for any analysis of this week’s economic data. So, I apologize up front, but as I write this, it is very, very late Thursday night (or is it Friday morning?) and this week’s update is going to be short and sweet.

Let’s get to it.

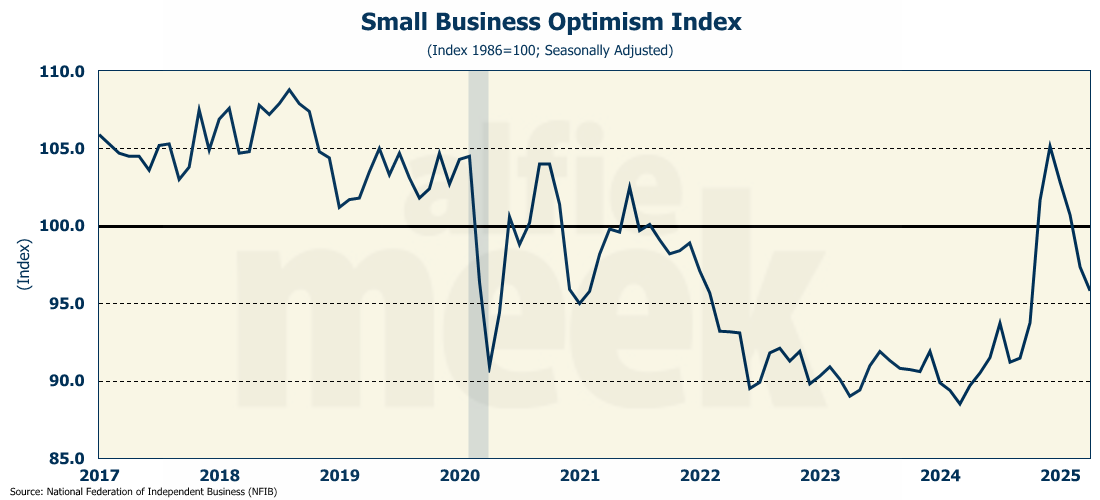

Small Business Optimism

The optimism of small business owners continues to pull back from the post-election euphoria they felt in November (full release here). The decline was driven almost entirely by the “Uncertainty Index” which fell four points from March to 92. Even with all that is going on in the economy, that is still well above the historical average of 68. However, even with the current economic uncertainty, the number of small businesses that said they were planning on increasing employment grew in April. Further, just over one-third of business owners reported that they were unable to fill job openings in April, which was down six points from March. This is a positive sign for the labor market.

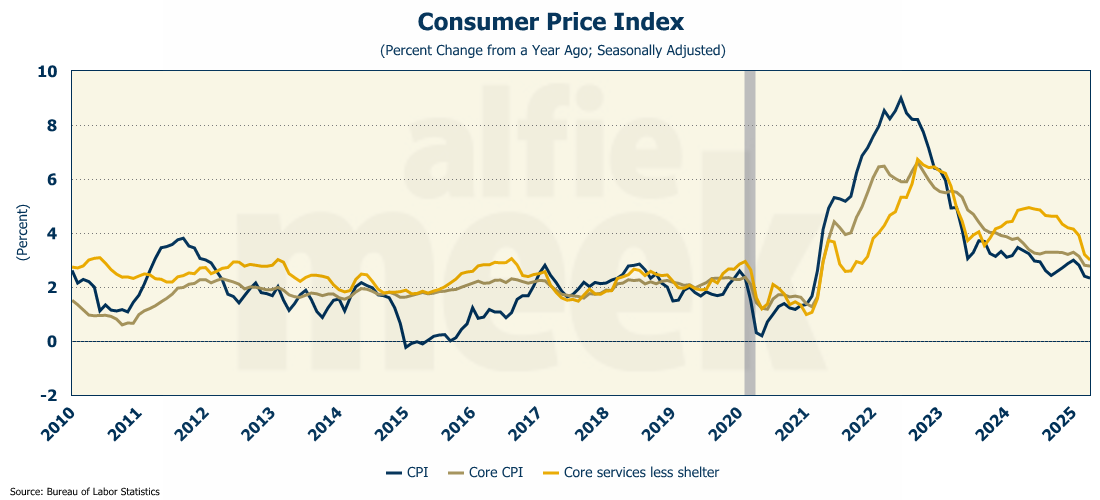

Consumer Price Index

Prices at the consumer level rose only 0.2% in April, lower than the 0.3% that was expected (full release here). On an annual basis, prices are 2.3% higher than last year. That is the lowest annual rate of inflation in 4 years.

Core CPI (CPI less food and energy) also rose 0.2%, which, again, was less than expected. On an annual basis, core CPI is running 2.8%. Clearly, falling energy prices helped the overall CPI as the price of oil fell by more than 10% during the month. Also, as a point of recent interest, the price of eggs fell 12.7% in April. That was the biggest monthly drop since 1984 and translates to an annualized rate of -80.3%. (I'm not sure why the price of eggs has captured national attention, but I get asked about it a lot, so there you go.)

Super Core CPI (services CPI less shelter) fell to right at 3% year-over-year. That is the lowest that indicator has been since December 2021.

Clearly, any price impact of tariffs is not showing up in the data. Although, to be fair, you wouldn’t expect it to, given how many tariffs were waived and/or suspended after “Liberation Day” on April 2. Plus, it takes time for those price adjustments to work their way to the consumer. At the end of the day, I simply don’t expect any significant changes to the overall price level as a result of these tariffs. However, near-term increases in the price level are inevitable will be due to the fact that the growth in the money supply is accelerating, and it is now growing in excess of 4%.

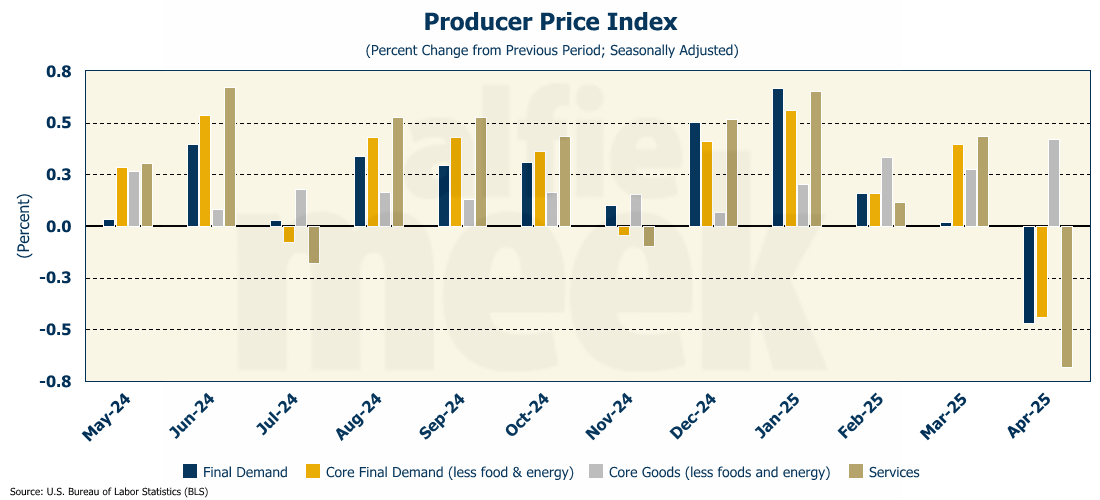

Producer Price Index

If tariffs aren’t showing up in CPI, they certainly aren’t showing up in PPI. The Producer Price Index posted the largest monthly decline since 2020, falling 0.5% in April (full release here). Ironically, the drop was fueled by the decline in egg prices, as well as fuel. But even if you remove food and energy, core PPI still dropped 0.4%. On an annual basis, PPI came in at 2.4% - the lowest level since September 2024.

Again, these numbers represent the very earliest stages of the tariffs and may increase in the coming months. However, as I have said in multiple posts, this doesn’t necessarily mean higher prices for consumers. A point also made this week by James Knightly, the Chief International Economist at ING, who wrote to clients, “There is little evidence, so far, that tariffs are inflationary and instead profit margins are being squeezed.” Yes. Like I pointed out last week, demand elasticity is a thing.

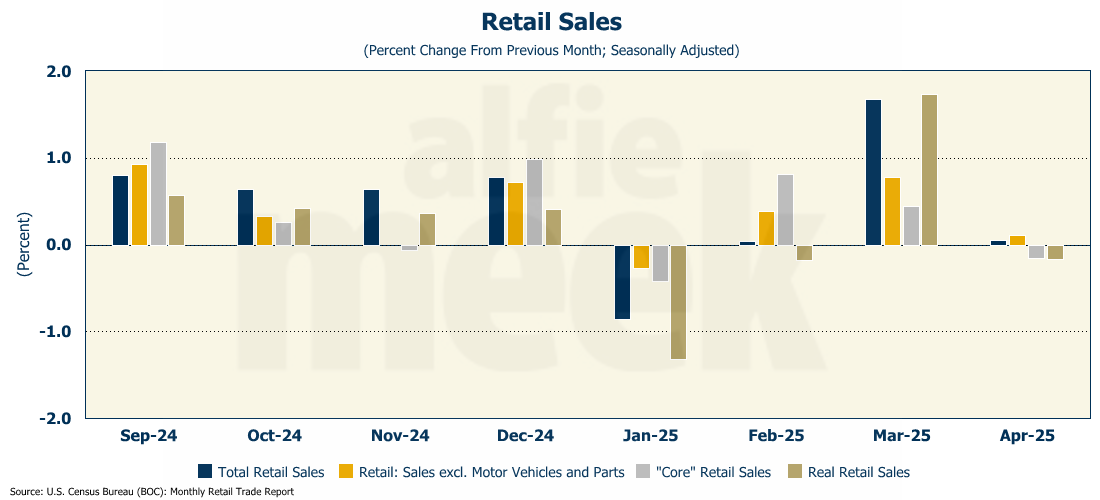

Retail Sales

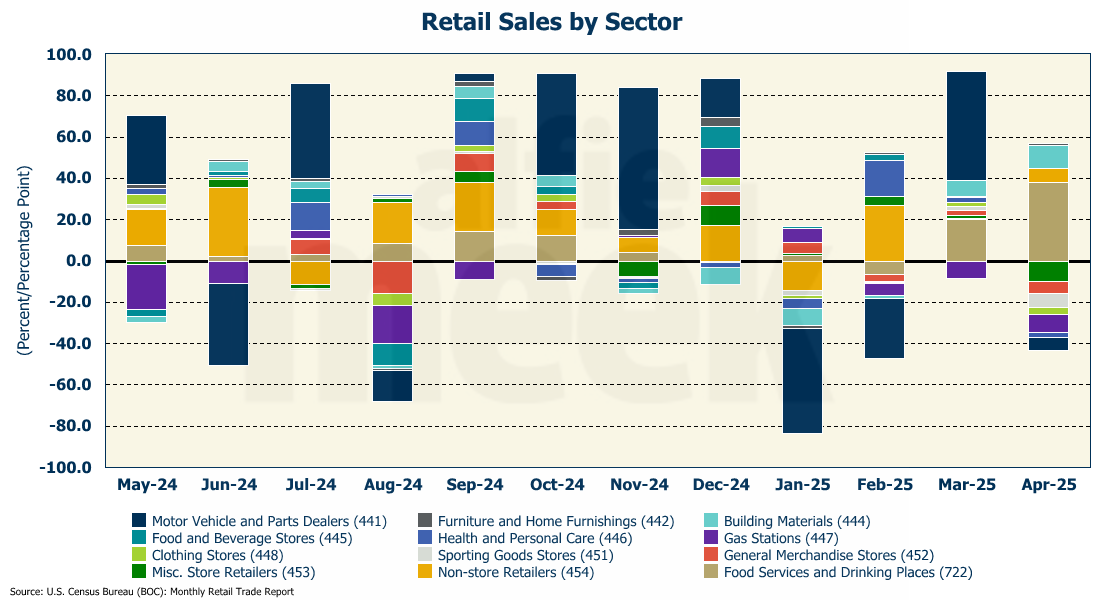

And because elasticity is a thing, retail sales were a bit weak in April, rising only 0.1% (full release here). If consumers didn’t need it, they didn’t buy it. Although, to be fair, this was mostly because of the front-loading consumers did in March to get ahead of any potential price increases (see graph below). However, despite the tariffs and the surrounding economic uncertainty, consumers still spent enough to keep the economy growing.

Looking at the details, it isn’t surprising that sales at gas stations fell, given that oil prices dropped significantly during the month. However, it does appear that consumers decided to go out to eat a lot in April. In fact, restaurant sales were up nearly 8% in the past year. This is a good sign, as consumers tend to eat out more when the economy is healthy and they feel comfortable in their jobs. The first quarter GDP number is looking more and more like a one-time anomaly due to front-loading imports ahead of tariffs and not an indication of underlying weakness.

Home Builder Confidence

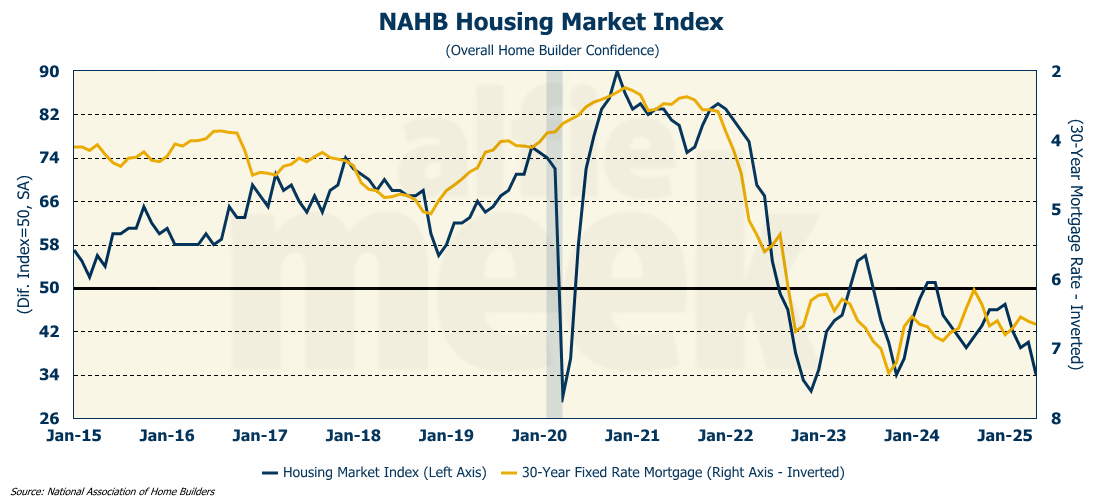

It would appear that home builders may need to start taking Prozac. Home builder confidence fell 6 points to 34 in May (well below expectations). That is the lowest level since January 2023, and close to the COVID low of April 2020 (full release here).

All three of the sub-indices fell in May, with the outlook for the next six months falling to the lowest level since 2023. The measure of current sales fell to the lowest level since 2022.

The chairman of the National Home Builders Association said that “The spring home buying season has gotten off to a slow start as persistent elevated interest rates, policy uncertainty, and building material cost factors” are depressing builder sentiment. In May, 34% of builders said they had to cut prices - the largest share since late 2023. Just over 6% of builders said they were using sales incentives.

But the fact is that builder sentiment has been down for a while, tracking closely with the 30-year mortgage rate, which has remained stubbornly high. And this week has seen the 10-year yield rise even higher. Housing affordability is just awful right now, even before any talk of tariffs. I myself have been looking at houses recently, and can not believe how unaffordable housing has become. As I scroll through the pages of homes for sale, I ask myself, ” Who can afford these?” Because I certainly can’t. And I believe that many people are coming to the same conclusion.

Building Permits & Housing Starts

Finally, this morning, we got the data on building permits and housing starts for April, and both came in below expectations. That isn’t surprising given the home builder confidence numbers above.

First, building permits, which came in at 1.41 million - below the expectations of 1.45 million (full release here). And permits were down across the board. Single-family permits fell 5.1% in April, and multi-family permits were down 3.7%. Only multi-family permits for 2-4 unit homes were up, and that was only 1.7%.

Housing starts came in at 1.36 million - below expectations, but up 1.6% from March. However, that growth was driven entirely by multi-family starts, as single-family starts fell 2.1% in April. Again, with buyers losing interest and rates stubbornly high, builders aren’t interested in bringing more inventory to market.

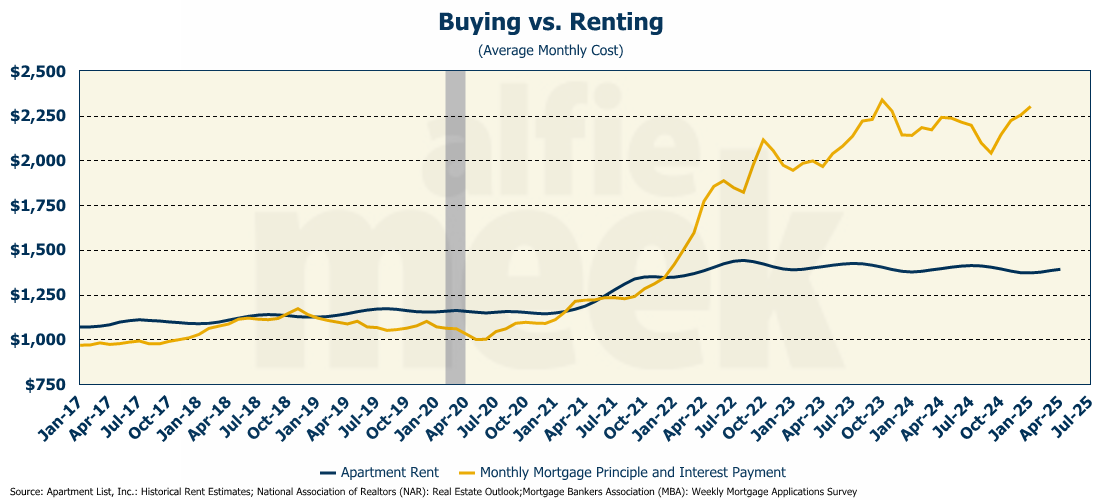

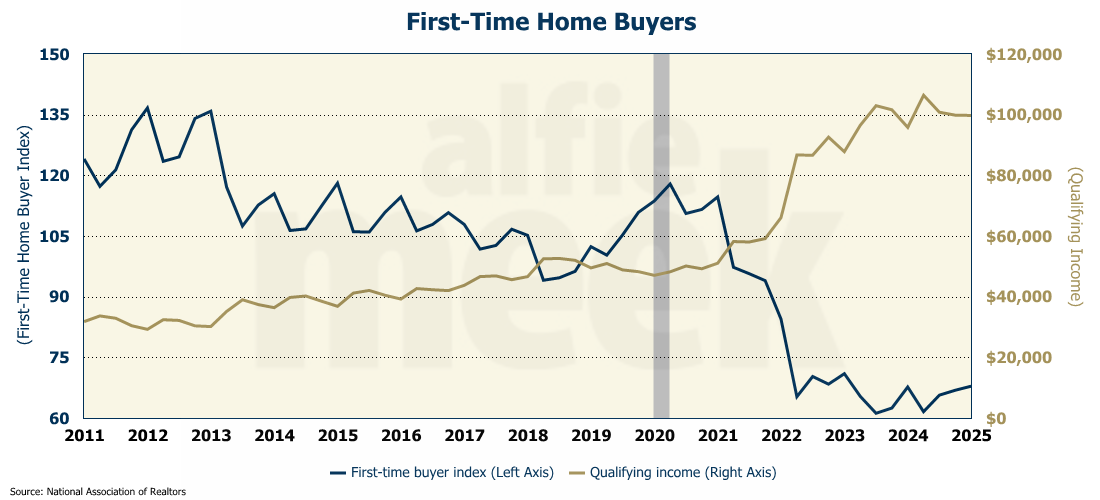

Multi-family starts, however, were up 10.7% in April, as renting continues to be a more financially attractive option for many, especially those who would otherwise be first-time home buyers. Apartment rents have been fairly steady since mid-2022, while the average monthly cost to buy is now 65% higher than the cost to rent. In December 2021, they were equal.

To purchase that “starter home," new buyers now need a minimum qualifying income of $100K. That is more than double what was needed pre-COVID, just five years ago.

One More Thing…

I want to thank the Coweta County Development Authority for having me out to speak at their board retreat this week. It was a good group, and I hope they found something useful in my comments.

Also, I want to congratulate my youngest son, who became engaged to his high-school sweetheart yesterday. His mother and I couldn’t be happier, and we wish them both all the best and look forward to what their future together holds.

As always, thank you for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.