Weekly Economic Update 05-30-25: New Home Sales; Durable Goods; Consumer Confidence; PCE Inflation; Personal Income & Spending; and Revised First Quarter GDP

Consumers feel more confident as inflation falls and incomes rise.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Whew! I lost no subscribers after my Artificial Intelligence experiment last week! I was worried about how that might turn out. Thanks for sticking with me.

The irony is that, after having written that post, I have used an AI assistant multiple times this week to find information that I was unable to locate on my own. And the AI assistant did the task in seconds, and the information it retrieved proved reliable each time. I could have saved a lot of time if I had just started with AI. Perhaps I will use this technology more than I originally thought. We’ll see how that goes.

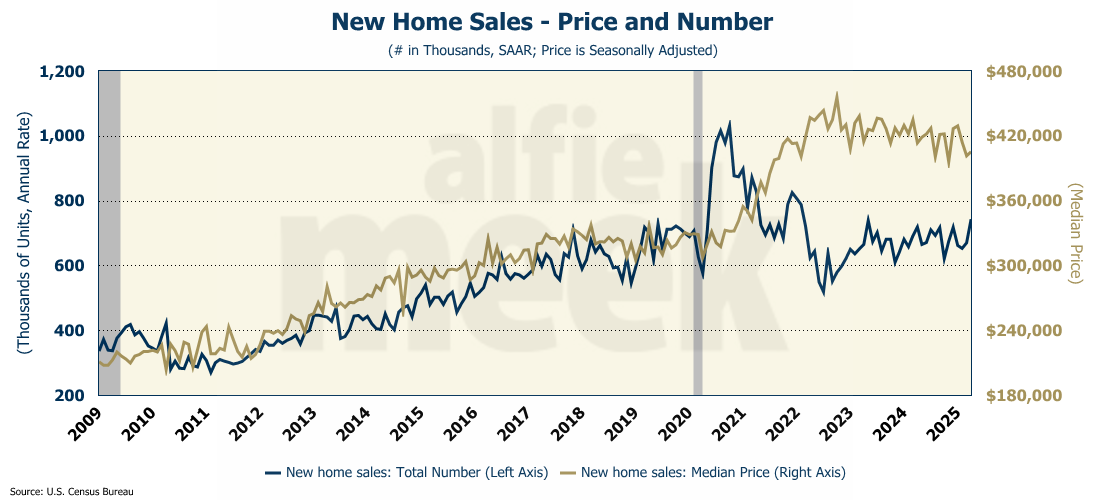

New Home Sales

This was certainly unexpected. Buyers flooded into the market in April and snatched up new homes at the fastest pace since February 2022 (full release here). Given the dour mood of home builders and mortgage rates rising slightly during the month, expectations were for a decline in new home sales.

Digging a little deeper, we find that some of these sales were driven by builder incentives, with 34% of builders reporting cutting prices - the largest share since December 2023. The average price cut was 5%. Overall, the median price of a new home is 2% below where it was a year ago.

Unfortunately, the April data is likely an anomaly. Even though summer is usually a busy season, with economic uncertainty at high levels, and the fact that builders simply are not starting construction on many single-family homes, sales are unlikely to be able to maintain this momentum.

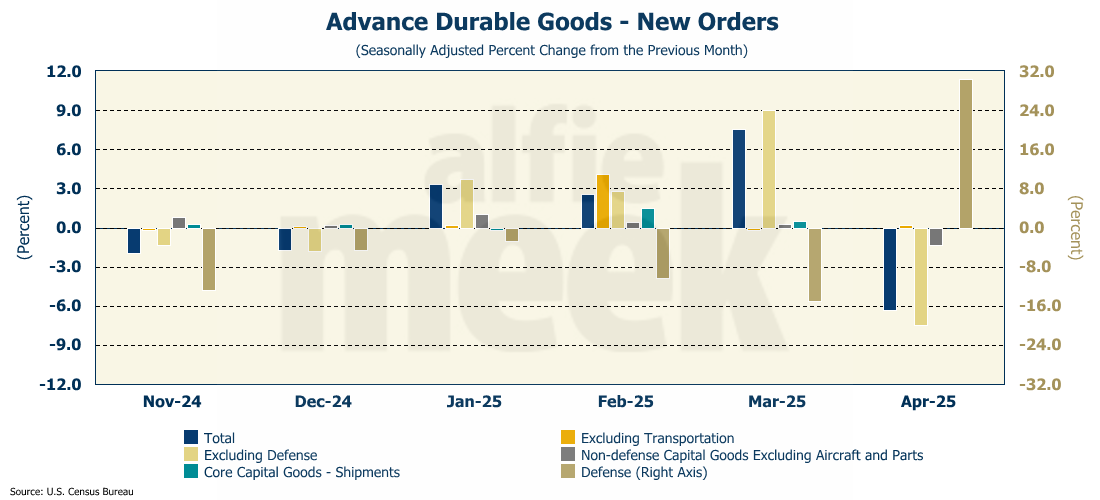

Durable Goods

If the new home sales data was a surprise, the durable goods data certainly was not. Last month, durable goods orders surged as companies tried to front-load their orders before the tariffs kicked in. As such, to no one’s surprise, in April, orders fell 6.3% on a month-over-month basis (full release here). If you exclude defense, the decline was even worse - 7.5%. Defense orders rose an astonishing 30.5% in the month. However, even with the drop, total durable goods orders are still running 4.8% above last year.

Because orders can be cancelled, data on the value of shipments is used by the government to help calculate Gross Domestic Product (GDP). Total capital goods shipments rose 3.2% in March, with non-defense capital goods rising 3.5%. However, the value of core capital goods shipments (capital goods less aircraft and all military hardware) decreased 0.1% in March.

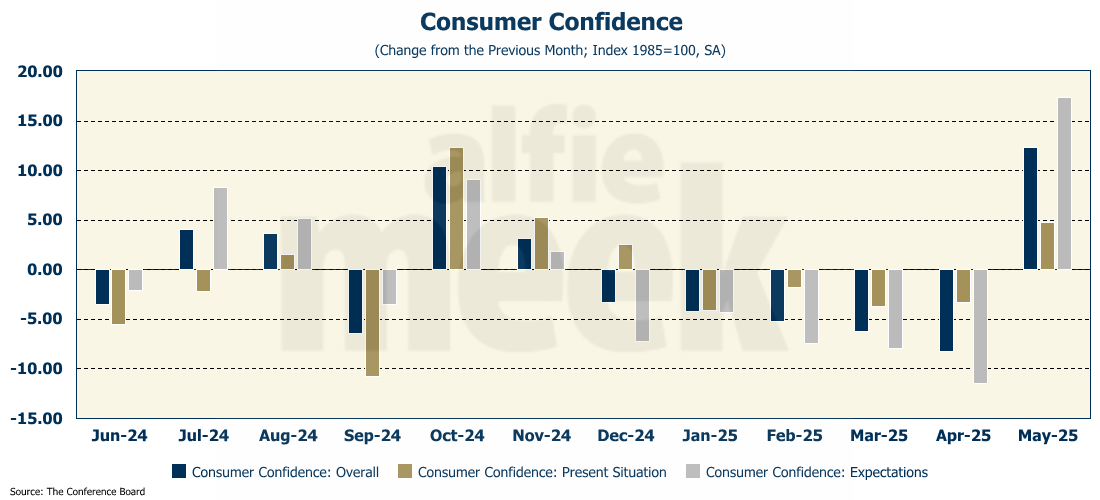

Consumer Confidence

It seems the recently announced tariff “pause” has lifted the confidence of consumers. Consumer confidence posted the largest one-month increase in four years, and the first monthly increase since the election (full release here). Confidence in the present economic situation rose for the first time in five months, and confidence in the future of the economy rose for the first time in six months.

And the increase in confidence appears to be happening across the board, among all age groups and all income brackets. It is quite rare for consumer confidence to move in the same direction across all income brackets, but it happened in May.

An even bigger surprise is the rebound in the percentage of respondents who have plans to purchase a home in the next six months. Despite the low home builder confidence we saw two weeks ago, it looks like consumers have come to grips with the interest rate environment as both plans to buy a home and an automobile jumped during the month. Also, for the first time since December, more respondents than not said that “jobs were plentiful.” These are positive signs for the rest of 2025, coming off a negative first-quarter GDP number.

PCE Inflation

It appears that those dreaded tariff price increases still haven’t materialized. The Fed’s “favorite” indicator of inflation - Personal Consumption Expenditures (PCE) - fell once again in April and is now sitting at 2.5% on a year-over-year basis, which is a four-year low (full release here). Top-line PCE fell to 2.1%, quite close to the Fed’s 2% target. The “super core” PCE (PCE services less shelter) also fell to a four-year low, and actually FELL month-over-month (i.e., deflation), which is the first time that has happened since the first month of the COVID pandemic.

Of course, if you have been a regular reader, this should be no surprise, as I explained in detail a few weeks ago.

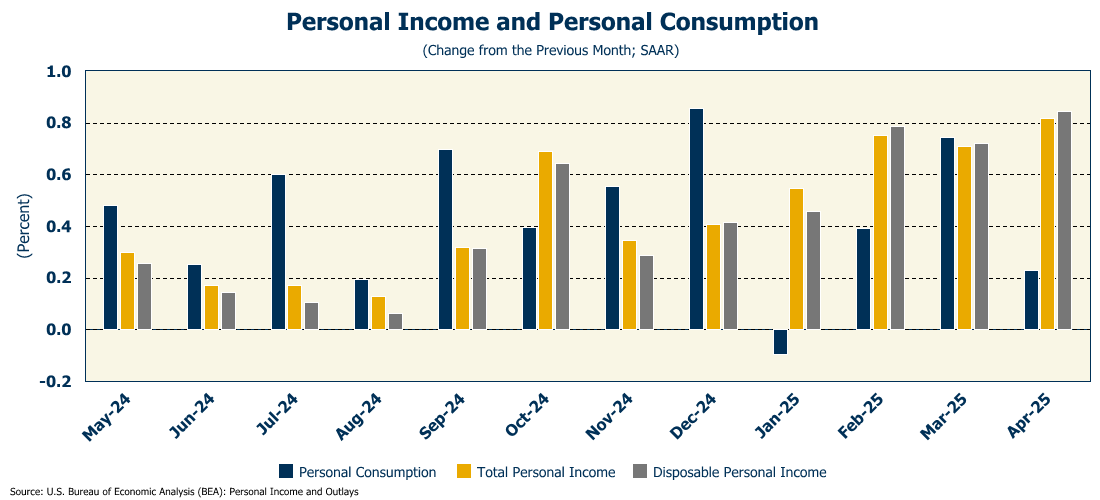

Personal Income & Spending

Despite all the fear-mongering surrounding the tariffs, as shown above, the rate of inflation is actually slowing, and it turns out that consumers are continuing to spend. And why not? Personal income grew at a blistering 0.8% rate in April - the fastest rate of income growth since January 2024 (full release here). On an annual basis, personal income is now 5.5% above where it was last April. Given that PCE inflation is running at nearly 2%, consumers’ income is finally outpacing inflation, and they are experiencing real income growth.

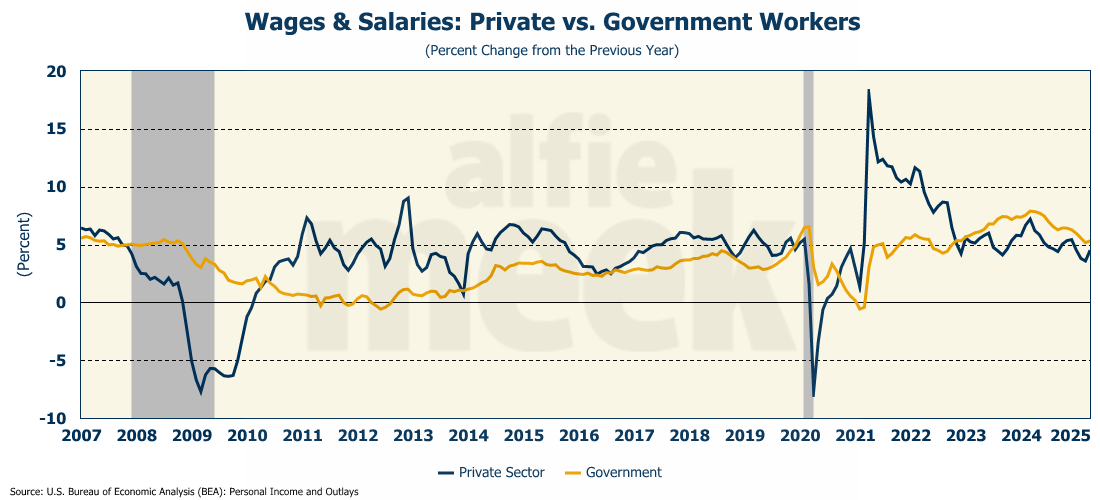

Both private-sector and government workers saw their incomes accelerate in April, with private-sector wages jumping to a 4.5% year-over-year growth rate, and government wages increasing to 5.3%. Government wage growth had been declining for the past year, but continues to outpace private sector growth.

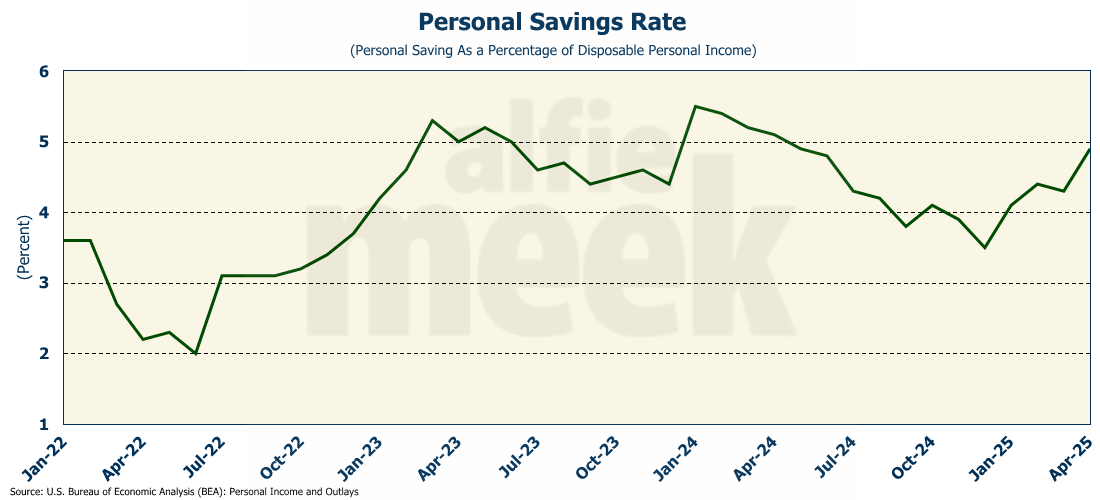

Overall spending grew 0.2% in the month and is up 5.4% year-over-year. Given that income significantly outpaced consumption in April, total savings grew $141 billion, raising the savings rate to 4.9%. Since December, the savings rate is up 140 basis points.

First Quarter GDP (revised)

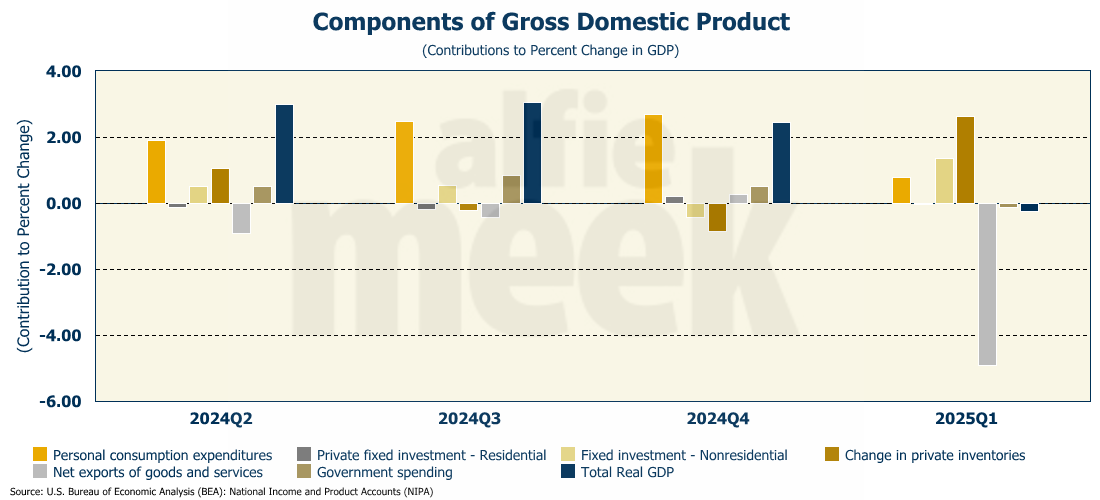

Finally, this week, we got the revised estimate of first quarter GDP, and it turns out the economy didn’t do as poorly as initially reported (full release here). According to the Bureau of Economic Analysis (BEA), the economy contracted 0.2% in the first quarter. The preliminary estimate released a month ago was -0.4%.

Where were the major revisions? Personal consumption grew at an annualized rate of 1.2%, down from the 1.8% initially reported. That makes the first quarter the weakest quarter for personal spending since the second quarter of 2023. However, non-residential fixed investment grew at an annual rate of 10.3%, which was even higher than the previously reported 9.8%. That level of business investment is a positive sign for the future economy, and as I pointed out a month ago, it reflects the explosion of data centers.

Of course, the front-loading of imports is what is driving the drop, but the opposite will occur going forward, so there is no reason to expect this to be the beginning of a broad-based downturn. In fact, the second quarter could very well be in excess of 3% growth.

One More Thing…

Last Monday, our nation celebrated Memorial Day, which is, in my opinion, one of our most important, if not THE most important, national holidays. I hope you took the time to remember those who gave their life for our country. It sounds pithy, but the fact remains that freedom isn’t free. Regardless of whether you are Republican or Democrat, conservative or liberal, right or left, the freedom you have to openly express your opinions, to “petition government for redress of grievances,” and to live and worship as you see fit is all due to those who gave their life for this country. I hope you remembered that this week.

As always, thank you for subscribing and reading this weekly update. If you haven’t already, please consider joining as a member, or even just “buying a coffee” (or two) to help support this effort. To do so, please click/scan the QR code below.