Weekly Economic Update 07-25-25: Leading Economic Indicators; Existing Home Sales; New Home Sales; and Durable Goods

Sales of new and existing homes continue to be slow, but prices appear to only move in one direction.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Not a lot going on this week. Next week, the Fed will meet and decide to hold interest rates steady, so there isn’t likely to be any news there either. Other than that, there just isn’t much going on in the economic world right now. And with Congress gone for their “summer recess,” it may be slow until after Labor Day.

Leading Economic Indicators

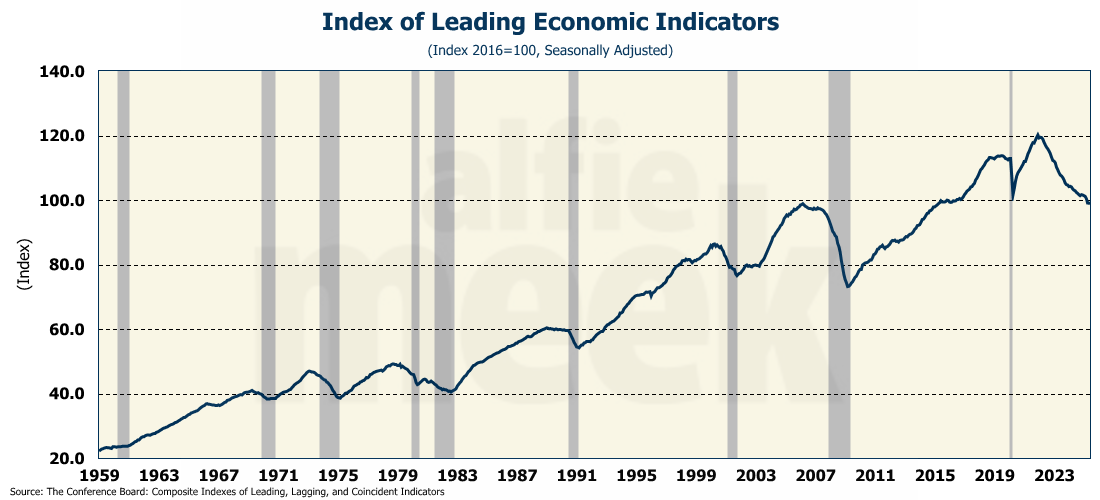

In fact, things are so slow this week that I must resort to reporting on the Index of Leading Economic Indicators (LEI). The index fell slightly in June, dropping to 98.8 from 99.1 (full release here). The index has fallen for 38 of the past 42 months, and now sits at its lowest level in 11 years.

According to The Conference Board, which publishes the LEI, “provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term.” But does it really? Because, as I look at the index, it has been signaling an economic downturn “in the near term” since late 2021, and it still hasn’t arrived.

The LEI would suggest that the U.S. economy is slowing. Next week, we will get our first read on GDP for the second quarter, and I expect that it will come in well above 2%. The LEI doesn’t appear to be significantly connected to the state of the economy in any meaningful way. Which begs the question….what good is it if it can’t serve the one function it was designed to perform? Someone at The Conference Board might want to break out their pencil and do some tweaking to the LEI.

Existing Home Sales

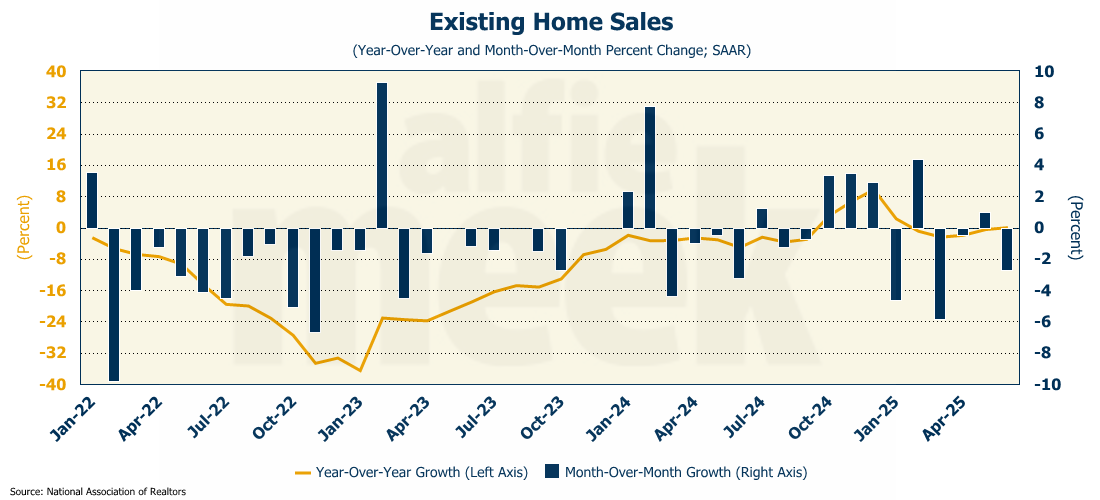

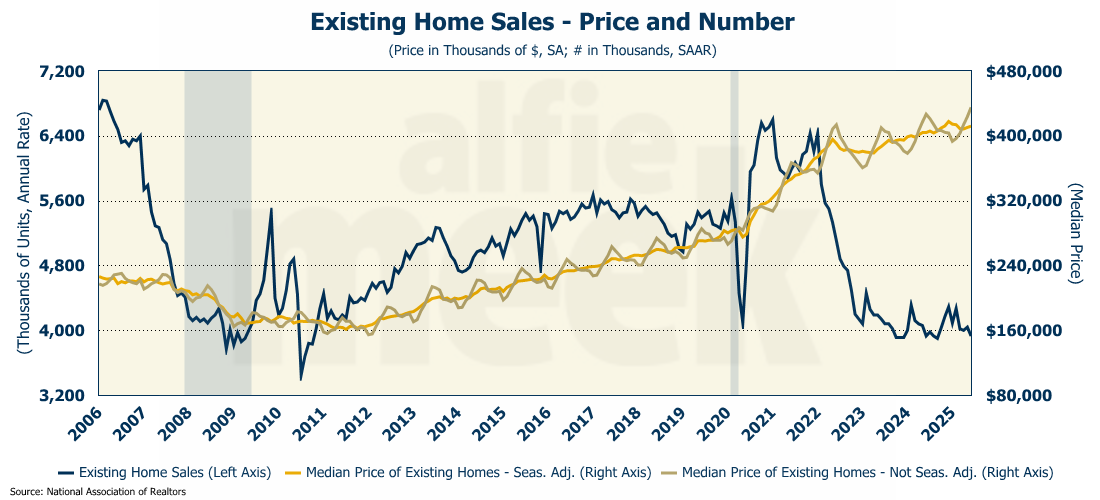

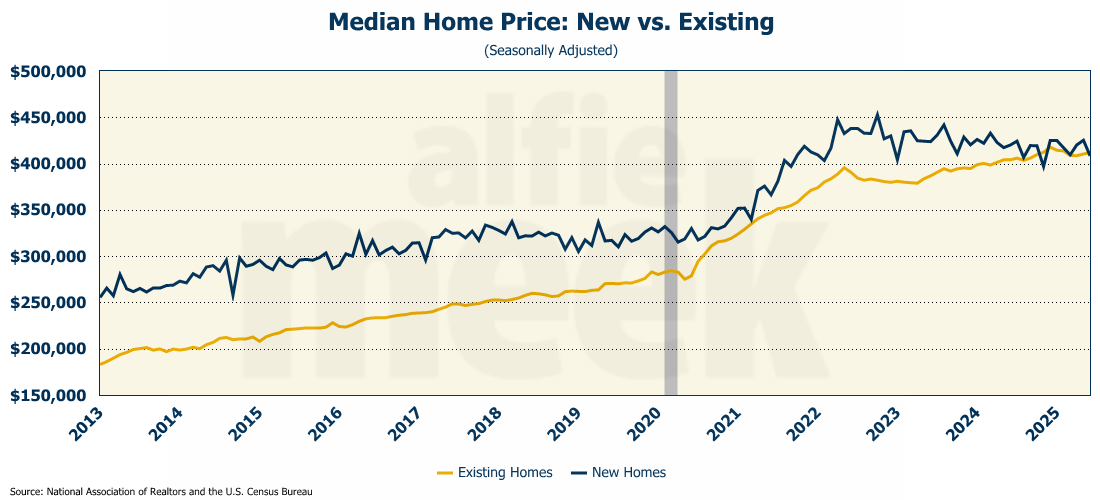

After a small rebound in May, existing home sales fell once again in June as mortgage rates ticked back up (full release here). For the month, sales were down 2.7% from the pace in May, which brought them to the exact same level they were one year ago - 3.93 million units on an annual basis.

Existing home sales have been hovering around the 4 million unit level since 2023…about as long as the 30-year mortgage rate has been bouncing around 7%. Ironically, even with high rates and slow sales, the prices of existing homes continue to rise. The median price of an existing home is up 2% from one year ago, and hit an all-time high in June at $435,300 (not adjusted for seasonality). However, there are signs that buyers have had enough. In June, 21% of the homes sold were above list price, down from 28% in May.

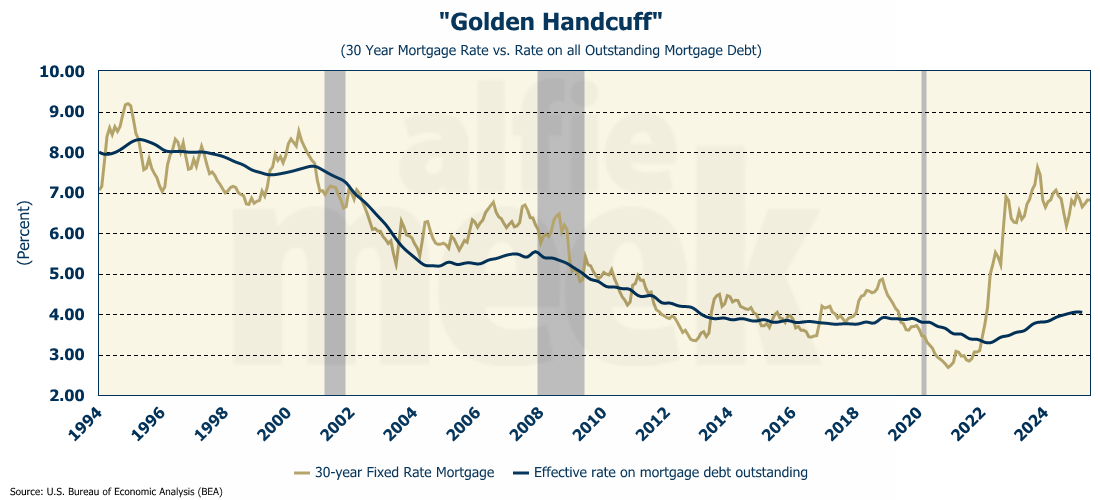

The “golden handcuff” is still a major issue. According to Goldman Sachs, about 87% of all mortgage holders have rates below current rates, and roughly two-thirds have a rate more than 200 basis points below current rates. Unless you absolutely have to, there is simply no interest in moving and losing the financial benefits of having a low rate. In total, the current rate is 280 basis points above the rate on all outstanding mortgages.

According to an analysis by the National Association of Realtors (not exactly an unbiased group), a 30-year mortgage rate of 6% would lead to roughly half a million more homes sold, and 160,000 renters becoming first-time homeowners.

Unfortunately, given the level of federal debt, the bond market is unlikely to bring rates down anytime soon. The current administration believes that the high rates are the result of the Fed’s interest rate policy, and not the excessive level of Federal debt.

As I pointed out last week, this isn’t the case. I’m no fan of Chair Powell, but if he does lower rates, the current administration would be saddled with high levels of inflation (higher than what is already headed our way), and there would be virtually no change to mortgage rates. The President may want to be careful what he wishes for.

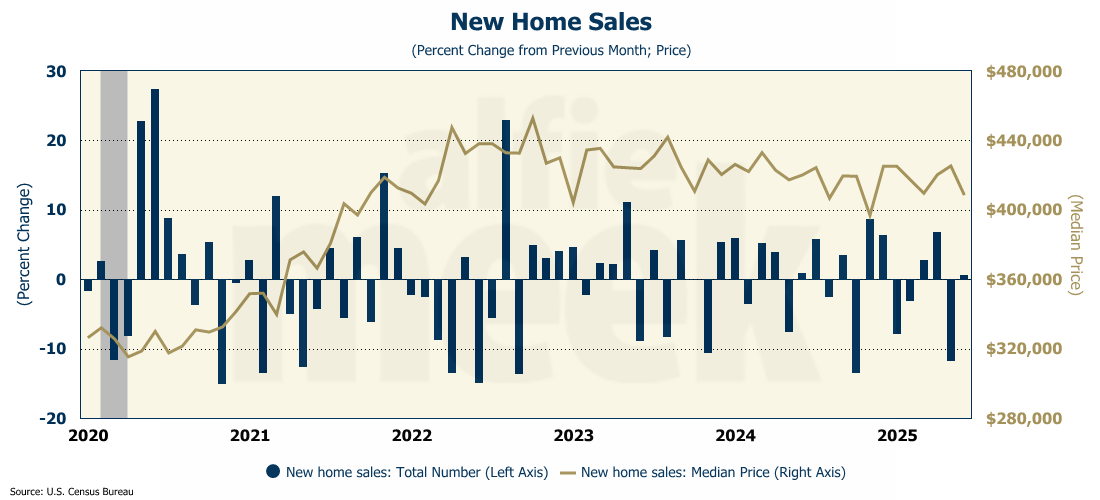

New Home Sales

While existing home sales fell in June, new home sales rose slightly, up 0.6% from May. Of course, in May, they had plunged 11.6% so a rebound was likely. However, the paltry size of the rebound is concerning. On a year-over-year basis, new home sales were down 6.6% (full release here).

Of more interest is the fact that the median price for a new home fell to $408,500 on a seasonally adjusted basis. Above, I reported that existing homes set an all-time record at $435,300, but that wasn’t adjusted for seasonality. On a seasonally adjusted basis, the median price of an existing home was $412,000. So, to be clear, the median price of a new home is LESS than that of an existing home. That is something that doesn’t happen very often.

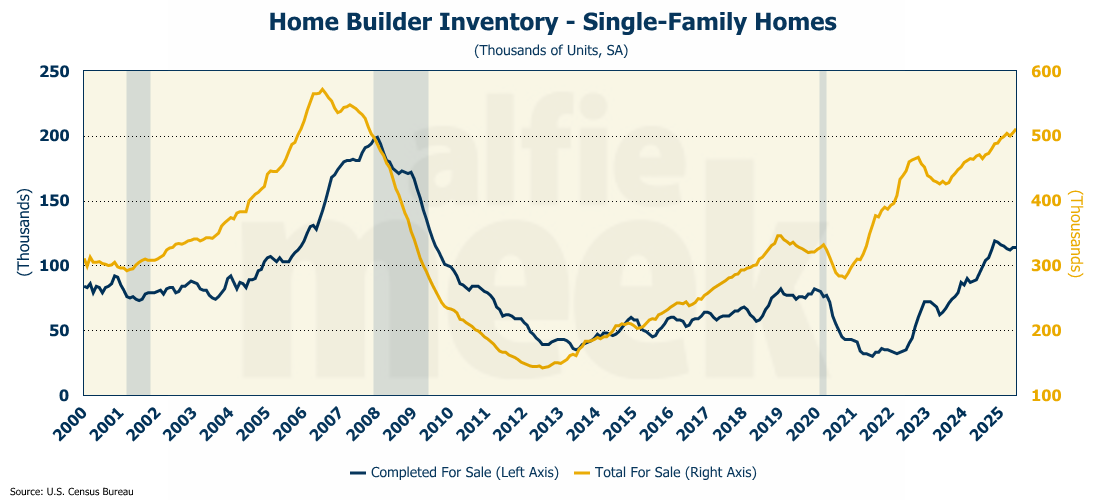

One reason the price of new homes is falling is that inventory continues to increase. The number of new homes for sale rose to 511K, the highest since the housing crash/financial crisis in 2007-08.

Durable Goods

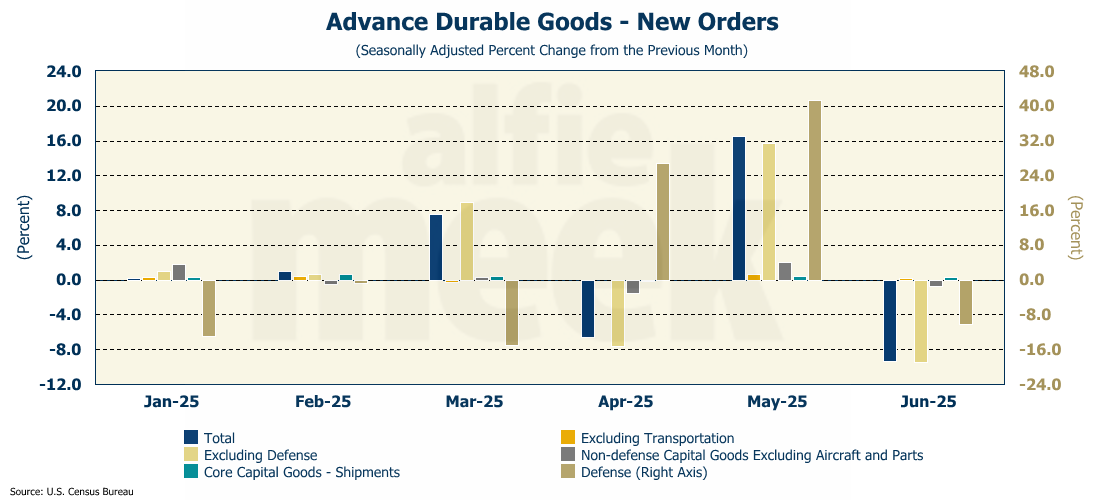

Finally, this morning the Census Bureau released the advanced data on durable goods orders for June, and they fell considerably (full release here). However, the drop was fully anticipated. You may recall that in May, new orders shot up due to a lot of orders for Boeing aircraft on the heals of the President’s Middle East trip. As such, the drop in June was expected. The good news is that the drop wasn’t quite as bad as experts were expecting (-9.3% actual vs. -10.7% expected).

If you exclude the volatile transportation sector, orders were actually up 0.25% in June, and were up 2.2% over last year. Core capital goods shipments (shipments excluding defense and aircraft) were up 0.4% in June, which was better than expected and supports the expectation of a good GDP report for the second quarter. We will find out next week if those expecations are realized.

One More Thing…

As always, thank you for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.