Weekly Economic Update 11-08-24: Election Results; The Fed Moves; Factory Orders; ISM Services; Consumer Credit; and Consumer Sentiment

It's finally over! But the Fed continues down the wrong path.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Thank heaven, it is finally over!

Much of the population is ecstatic while the rest are down right despondent. I don’t know into which camp you happen to fall. But I think it is safe to say that we are all just glad that it is finally over and we can get on with our lives. No more commercials; no more robo-calls; no more spam texts; no more full-color mailers; nor more yard signs; and no more strangers knocking on your door.

While we are all glad it is over, if you read this blog, you shouldn’t have been surprised by the outcome. I pointed out a few weeks ago, the economics of elections told us who was going to win. As I wrote then, since 1960, if you have a recession in the 3rd or 4th year of your term, your party loses the White House. Period. There are no exceptions to this rule.

Now technically, they haven’t declared a recession, but $1.5 trillion annual federal deficits have kept it at bay. But even so…no recession.

So, the second rule is that if you don’t have a recession, or can contain any recession to years 1 or 2 of your term, your party WILL retain the White House, but only IF the person running is an incumbent. Period. There are no exceptions to this rule.

But here is the crux of it…they didn’t run the incumbent. That leads us to rule #3...even if you can avoid an “official” recession, or contain it to years 1 or 2 of your term, but you run a non-incumbent, your party loses - virtually every time. (The only single exception to this rule was George H. W. Bush in 1988.) So, even with a good economy, the incumbent party lost when the incumbent wasn’t running….

1968 - Johnson drops out late because of Vietnam and the party ran Humphrey

2000 - Clinton was term-limited and the party ran Gore

2016 - Obama was term-limited and the party ran Clinton

2024 - Biden dropped out and the party ran Harris

History repeats and trends can tell us a lot if we are just willing to listen.

But even if we ignore history, the fact remains…the country simply wasn’t going to re-elect an administration that oversaw 20% inflation over 4 years; slow real wage growth; skyrocketing housing costs with high mortgage rates; and exploding consumer debt. It just was not going to happen.

That isn’t to say all those things were their fault, or that that next administration will do much better. Maybe they will…maybe they won’t. For better or worse, Presidential administrations get too much credit/blame for the economy. But that is how politics work. Unfortunately, many of the problems with the economy are structural and improving them will be like trying to turn a battleship. The in-coming administration has some very big policy ideas…we’ll see if they can actually implement them well enough to make a difference.

Federal Funds Rate

But the Fed is certainly not going to help. Thursday afternoon they cut rates by another 25 basis points. That makes a total of 75 basis points since September 18th. But the 10-year Treasury rate (which drives the 30-year mortgage) is up 61 basis points over the same period! So, their rate cutting isn’t helping consumers, and instead, is going to lead to future inflation.

What was most telling were some of the changes in their statement….most notably, they removed language that said they had “gained greater confidence that inflation is moving sustainable toward 2 percent.” So, maybe they no longer think that inflation is moving in that direction? Or maybe they think they have achieved it? The data proves the latter is false, so if it is the former….why are they still cutting rates? What a mess. And the latest rumor is that the new administration plans to keep Chair Powell. Not the best way for them to start. (Of course, firing Powell may not be allowed under law, so perhaps he has no choice. But he sure doesn’t have to re-appoint him!)

Another interesting comment from Powell….they may start RAISING interest rates next year! What?!? All we have heard for months is rate cuts for as far as they eye can see. Now, 2 days after the election of a guy that likes to suggest the Fed Chair may need to go, Powell says rates may be going back up? But it’s OK…the Fed is not political. Right. The irony is…rates actually do need to go up! A political Fed may actually end up helping the new administration without realizing it.

Factory Orders

Orders for goods made in U.S. factories fell 0.5% in September, and are down 1.6% from one year ago (full release here). That is the fourth decline in the past five months. Core orders (ex. transportation) rose slightly 0.1%.

Two weeks ago, when we got the preliminary data, I mentioned that orders placed for new business equipment fell, and last month’s data had been revised lower. Data being revised lower has been a consistent trend over the past few years. In fact, for six of the last seven months, durable goods orders data have been revised lower, and monthly growth for August was just revised from -0.2% to -0.8%! How can the Fed possibly make any informed decisions when the data is so unreliable?

ISM Services

The ISM Services Index unexpectedly shot up to 56.0 - the highest level since August 2022 (full release here). Expectations were for a slight decline! The survey saw employment jump back into expansion territory. (But wait!?! what about the hurricane? I thought last month they said that was why employment was so low!)

The new orders index dipped, but is still well above 50, and the prices paid index, a measure of inflation, also dipped for the month, but again, is still well above 50 in expansion territory. That is consistent with what we see in both the CPI and PCE services price indices. But even a slight move down is a welcome sight.

Consumer Credit

Total consumer credit only rose $6 billion in September (full release here). I say “only $6 billion” because it was expected to rise $13 billion! Total revolving debt was up only $1 billion, after dropping $2 billion last month. Is the consumer slowing down? I’ve given up thinking so. More likely they are just storing up for the Christmas season! Later in this month we will get a major quarterly update on consumer debt and that should give us a good look at where the consumer stands heading into Christmas.

Consumer Sentiment

Finally this morning, the University of Michigan released preliminary consumer sentiment for November (full release here). While still well below pre-COVID levels, sentiment is up for the fourth month in a row. Sentiment in the present dipped a little, but feelings about the future rose considerably.

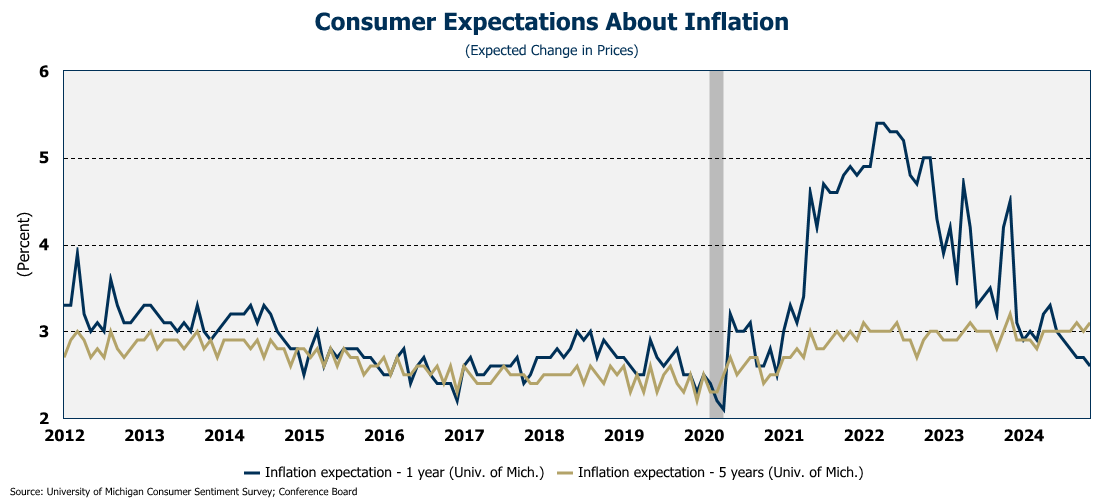

Part of that increase is due to the fact that inflation expectations for one-year out fell once again and are now down to 2.6%. However, 5-year inflation expectation ticked up and are still above 3%.

The survey also breaks the data down by political party. In this preliminary data, Democrats' confidence rose; Independents confidence tumbled; and Republicans’ confidence jumped significantly. The survey was taken before the election. Guessing some of those numbers will be much different next month.

Welcome New Members!

Last week I got my very first GOLD level member - Andrew Hajduk! Thank you Andrew! Your support means a great deal and will help cover the cost of all the data subscriptions I need to keep this update going! We also got some new bronze-level members, including Carlos Alvarez, Tommy Jennings, and my good friend Steve Goins.

Each month, I am going to acknowledge all my gold and silver members by name. In addition to Andrew, at the silver level we have Dan McRae who has been a long-time friend, supporter, and promoter of this update. Thanks again Dan!

If you are reading and sharing this update weekly, I invite you to click/scan the QR code below to join Andrew, Dan, Carlos, Tommy, Steve, and several readers who have become “members” to support this update!

I also want to give a shout out to Eric Danley who “bought some coffees” this week. (It’s nice when your brother-in-law likes you enough to support your efforts!) And thanks to John Knight who also bought coffee this week, as well as a contributor who did leave a name. Thanks again for all the support!