Weekly Economic Update 04-18-25: Retail Sales; Industrial Production; Home Builder Confidence; Building Permits and Housing Starts

Home construction slows as mortgage rates rebound and builders sour on the outlook.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Coming back from vacation is always tough. The “IN” box has a week’s worth of e-mails. Most of it is junk, but you still have to go through it all and make sure you don’t miss anything. Then you have all the snail mail, the voice mail, the text messages, the packages (that may or may not have been stolen off your front porch), picking up the dogs from the sitter, and wondering if your fish survived not being fed for a week (oops).

With so much to catch up on, it can be difficult to focus on anything else. It was Wednesday night before I got around to starting this week’s update. And trying to follow the economic and financial news recently is like trying to catch the wind. Every day brings developments that are the antithesis of the day before, and that makes writing a weekly blog tough.

So, let me focus once again on a common theme…inflation is still an issue, and it was well before any talk of tariffs. I have been making the case here for some time that the fight against inflation isn’t over. I have further made the case that talk of tariffs only muddies the water, as tariffs will undoubtedly be blamed for inflation that was already in the works.

Let me give you some new evidence that inflation is still a problem. You may or may not be familiar with Treasury Inflation Protected Securities, or TIPS. TIPS are Treasury bonds designed to protect against inflation by adjusting the value of the principal based on inflation rates, and like other bonds, they are issued with varying maturities. As such, we can look at the difference between two different maturities and calculate a “real” (i.e., inflation-adjusted) yield curve. A steepening of the real yield curve is typically consistent with rises in inflation. And the real yield curve is steepening dramatically. More importantly, it has been steepening since last summer, long before tariffs, or even a Trump administration, were a variable.

I don’t possess any special keen insight here. The Federal Reserve has all the same data I do, and this is why New York Fed President John Williams (and others) are openly saying they see no need to adjust monetary policy and cut rates. In their speeches over the past couple of weeks, Fed officials have, for the most part, all been singing the same tune…there is a risk of rising inflation in the coming year. The Fed is right to push back against the administration’s call to cut rates. Of course, they want to blame the inflation risk on tariffs and not their own irresponsible monetary policy of the past 5 years. But whatever the reason, the end result of not cutting rates is the right call.

Retail Sales

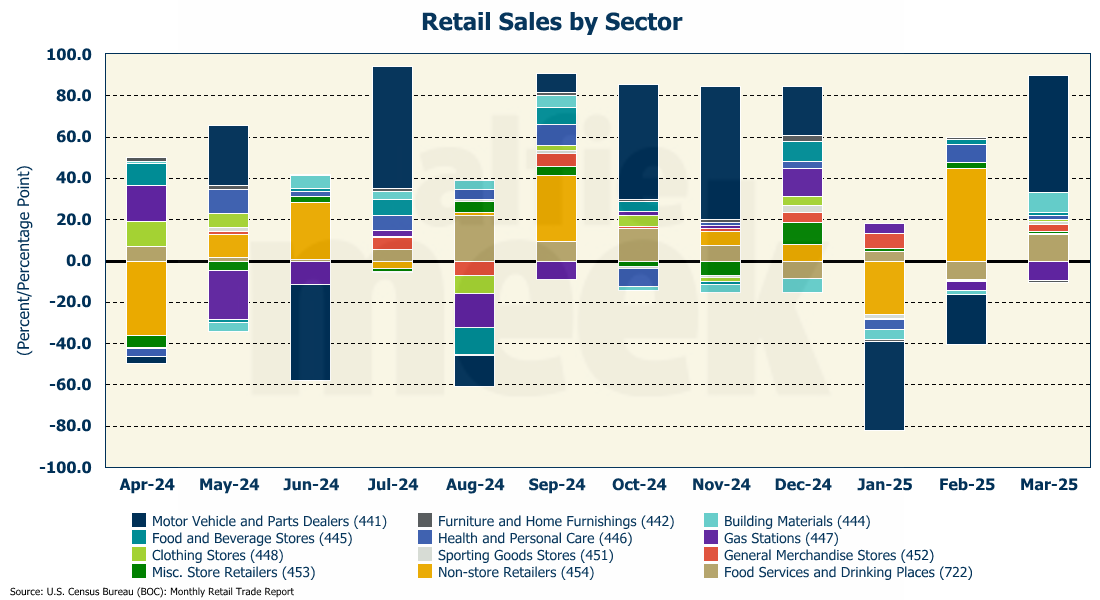

Despite the drastic slowdown in consumer credit that we saw last week, consumers are still spending. According to the Census Bureau, retail sales jumped 1.4% in March, higher than the 1.2% that was expected. That was the largest monthly increase since January 2023, and it brought the annual growth rate to 4.6% (full release here).

Looking at each sector, the report was dominated by growth in motor vehicles and parts, followed by building materials. It is very possible that both sectors were boosted by consumers trying to beat the imposition of tariffs. However, even excluding automobiles, retail sales were still up 0.5%, which again was higher than expected.

As I have mentioned in the past, the only way I know to reconcile the falling consumer credit data with rising retail sales is if the spending is being done by high end consumers. I strongly suspect that is what is happening. And, as I have also pointed out before, if those consumers start to feel a decline in their wealth effect due to falling asset prices, then the consumption part of the economy will be at risk. And currently, the stock market is certainly not providing much of a wealth effect. Quite the opposite.

Industrial Production

Overall industrial production fell slightly in March, falling 0.3% from the all-time high it posted in February (full release here). However, manufacturing production was up for the fifth consecutive month, rising 0.3% both with and without motor vehicles included.

Capacity utilization fell slightly after posting three consecutive months of improvement, although again, manufacturing utilization was up. One wonders if the administration’s policy of trying to re-shore manufacturing is about to give a huge boost to a sector that was already poised for recovery.

Home Builder Confidence

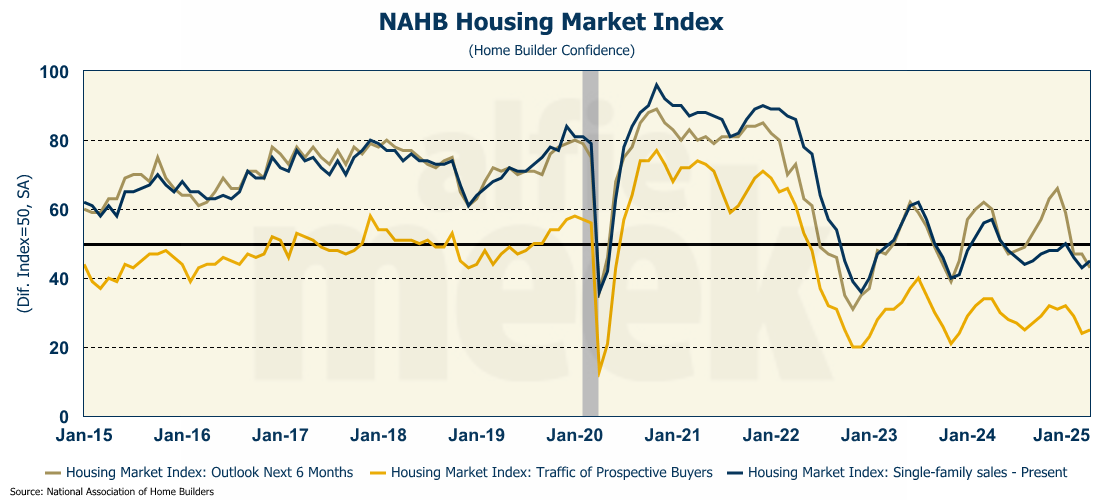

According to the National Association of Home Builders, home builder confidence ticked up slightly in April to 40 (full release here). Even though the number was up slightly, with the index well below 50, meaning that the mood of builders is quite pessimistic.

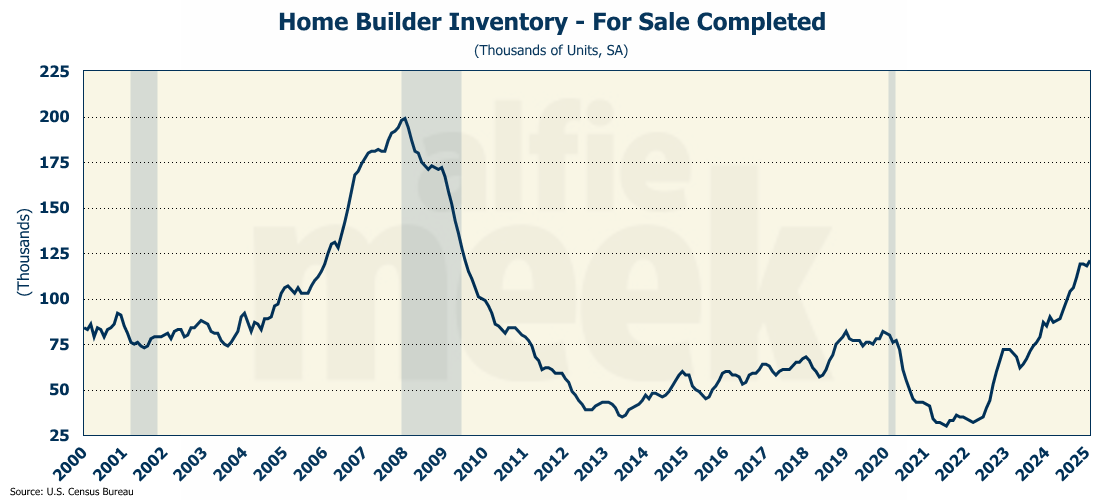

Builders did express some concern about potential cost increases due to tariffs on imported building materials. However, they seemed more concerned about their overall ability to sell homes. They have a significant inventory of finished homes, as well as homes under construction. In total, there are 121K newly completed homes for sale.

To make matters worse, they expect demand to stay weak because buyers face economic uncertainty, and that will obviously affect their decision to purchase a home. Digging deeper into the index, we see that their outlook about the next 6 months is the lowest it has been since late 2023. And the traffic of prospective buyers, while it did move up 1 point, is still hovering around historic lows.

Building Permits & Housing Starts

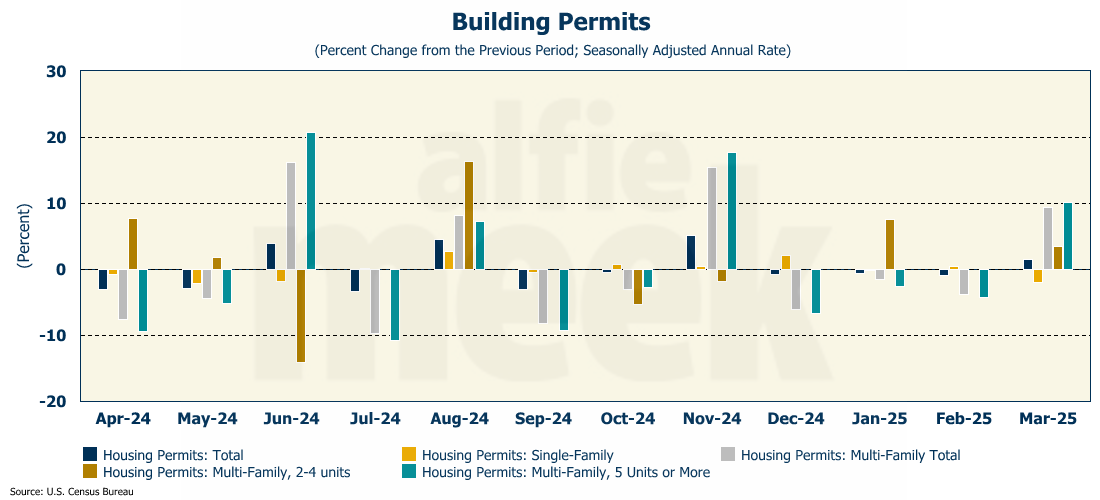

Lastly, this week, we got the March read on building permits and housing starts (full release here). After three consecutive months of decline, we got a very slight increase in building permits in March, but it was totally driven by the increase in large, multi-family units, which jumped 10.1%. Permits for single-family homes declined by 2%.

If you read this update regularly, you know that last month I said, “given the recent declines in homebuilder sentiment and the recent declines in permits, any improvement in housing starts will be short-lived.” Well, the March data proves me correct. Total housing starts fell 11.4% in March, and single-family starts were down 14.2%. With rates moving up and home builder confidence down, a drop was expected, but the actual data came in more than 2x lower than what was anticipated.

The drop in single-family starts was the largest single-month drop since April 2020 - the beginning of COVID. Given the rate environment and the economic uncertainty, builders are slowing down on projects. The number of single-family homes under construction dropped to the lowest point since February 2021.

One More Thing…

I really do appreciate everyone who subscribes to this weekly economic update. If you find it informative or useful, please share it with your network. I need about 300 more subscribers to hit my goal for this year. I am going to have to make some decisions about the future of the update in the coming months, and I need to get as many subscribers as possible.

Also, as always, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.