Weekly Economic Update 08-01-25: 2nd Quarter GDP; PCE Inflation; Personal Income & Spending; Case-Shiller Home Price Index; JOLTS; and July Employment

GDP was strong in the second quarter, but the labor market is in free fall, and the Fed is between a rock and a hard place.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I often like to begin this weekly article with a missive on some current policy discussion or economic event that is of interest. However, with Congress on vacation, and the President in Scotland playing golf, there hasn’t been much to discuss.

And then the Fed met this week. Normally, that wouldn’t bring much to talk about either, as they held rates constant - much to the consternation of the President. However, there was one interesting piece of news that came out of the Fed meeting. For the first time since 1993, TWO of the voting members of the Board of Governors voted against the majority. Michelle Bowman and Christopher Waller both wanted to lower the rate by 25 basis points.

Neither Bowman nor Waller are Presidents of Federal Reserve Banks. Bowman is the Vice-Chair for Supervision, and Waller is an academic economist that used to work at Indiana University and was a visiting scholar at the Federal Reserve Bank of St. Louis. Not surprisingly, both were appointed to the Federal Reserve by President Trump during his first term. So much for the Federal Reserve not being political.

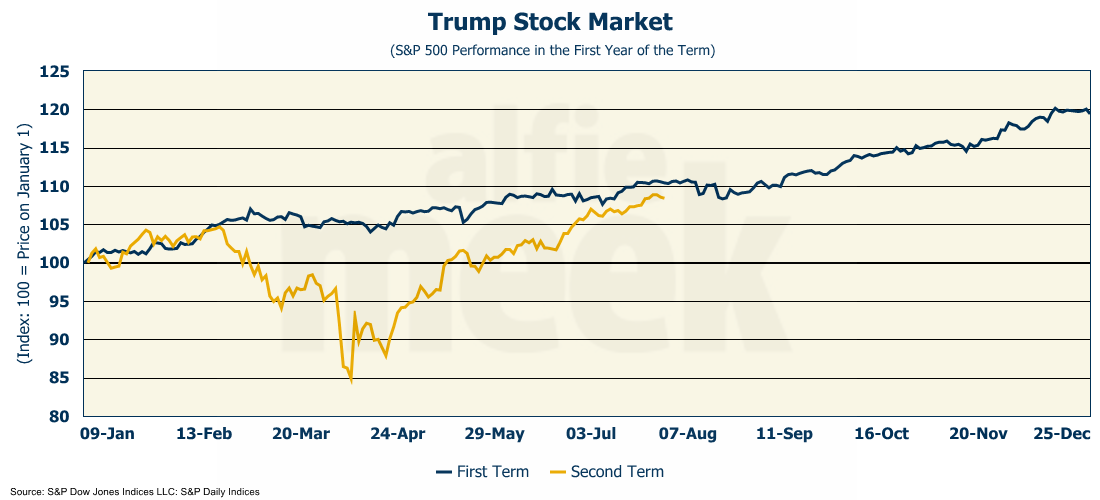

Despite the Fed holding rates constant, the markets took it in stride and continue to rise. Despite falling 15% earlier this year, they are back on pace to perform as well, if not better, than they did during Trump’s first term. Back on “Liberation Day” I talked about being “liberated from a significant portion of my retirement portfolio.” If you rode that out, you should be pretty happy about now.

2nd Quarter GDP (Advanced Estimate)

I’ll start with the biggest data release of the week - the advanced estimate of 2nd quarter GDP. Just a few weeks ago, at the end of June, I said that “Even with weak consumer spending, the second quarter GDP should be in excess of 3%.” Well, according to the first read, 2nd quarter GDP was exactly 3% (full release here). Not a bad forecast on my part. Especially when everyone else was saying it would be only 2.3%.

As I expected, net exports were a huge positive in the 2nd quarter due to the bounce back from the plunge in the first quarter as everyone raced to get out in front of the tariffs. Consumer spending also increased significantly and contributed 1% to the overall rate. That is up from 0.31% in the first quarter.

Of course, the change in private inventories was a drag on the number, as retailers unloaded all the inventory they had stocked up ahead of the tariffs.

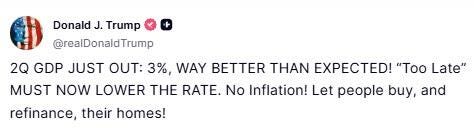

In total, it was a very good economic report. Too good if you are looking for a rate cut. When the economy is growing at 3%, there is no reason whatsoever for the Fed to cut rates. But apparently, the President doesn’t understand that. Immediately after the report was released, the President posted….

Yeah…that’s not how it works. The Fed cuts rates when the economy is slowing. That said, just as the first quarter was artificially suppressed, the second quarter rebound is artificially inflated. It would probably be more accurate to average the two, which gets you an economic growth rate of 1.3%-1.4%. Not great, but not enough for the Fed to move…especially with the money supply at record levels and growing at an annualized rate of 7.8%.

PCE Inflation

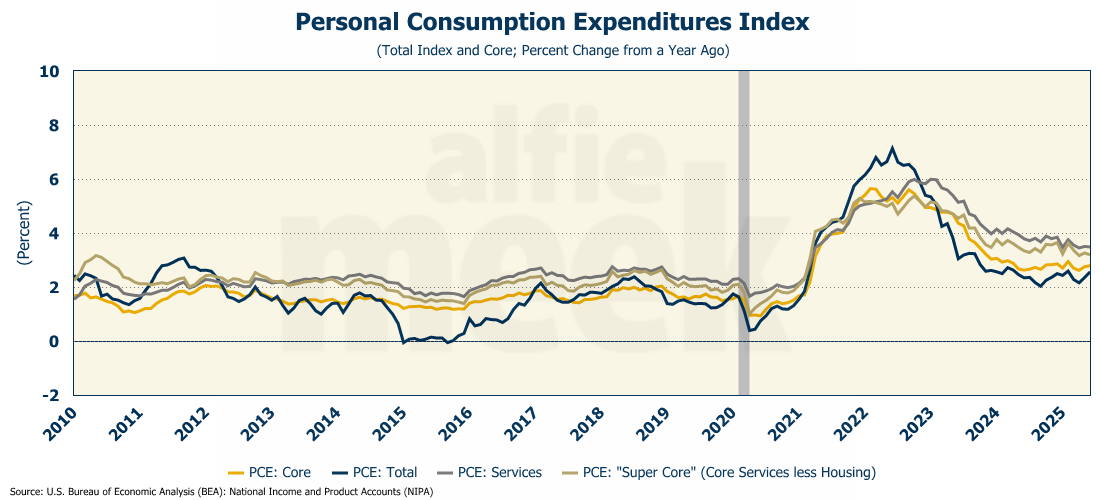

Speaking of rapid money growth, on Thursday, we got the latest read on Personal Consumption Expenditure (PCE) inflation and, not surprisingly, it came in hotter than expected, posting the largest increase in four months and rising to 2.6% year-over-year (full release here). Last month, it was running 2.4%. The monthly increase was 0.3%, which translates to 3.8% on an annualized basis.

The Fed’s favorite inflation gauge, core PCE (PCE less food and energy), also rose 0.3% in the month, and is running 2.8% year-over-year. That is also up from last month. Finally, service inflation was flat at 3.5% year-over-year.

I keep hearing how “inflation is low” and, as such, “the Fed needs to cut rates.” What data are they looking at? A significant portion of personal consumption is on services, and service inflation is running at 3.5%! And tariffs have nothing to do with service inflation. I found it humorous that in his statement this week, Fed Chair Powell said, “Services inflation has continued to ease…”. Really? Since January, the services PCE has been 3.5%, 3.8%, 3.6%, 3.5%, and 3.5%. Not a whole lot of “easing” there. Of course, he desperately wants service inflation to “ease” so that he can continue to blame tariffs for inflation rather than his own failed monetary policy.

Inflation will continue to rise as long as the Fed continues to grow the money supply at rates that far exceed real economic growth. It is simple math.

Personal Income & Spending

On a nominal basis, both personal income and spending rose 0.3% in June, following the surprise decline for both in May (full release here). Spending slightly outpaced income, which resulted in the second consecutive month of a decline in personal savings.

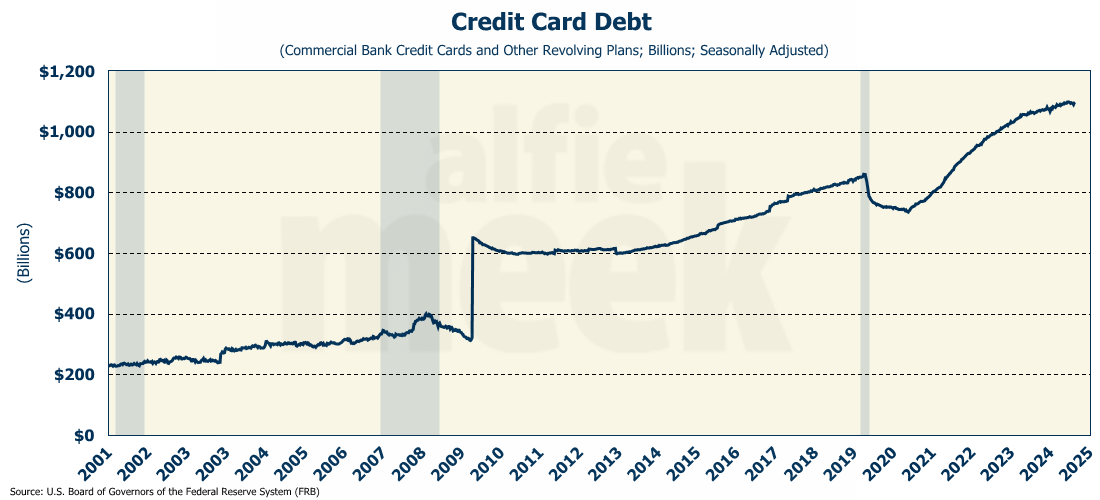

However, adjusted for inflation, real disposable personal income was slightly negative in June. That feeds into the fact that two weeks ago, U.S. credit card debt hit another record high of $1.1 trillion, and that does not include “buy now, pay later” spending, which is expected to set a record this year at $117 billion.

Case-Shiller Home Price Index

According to data from Case-Shiller, home prices in the 20 largest metro areas fell in May for the third consecutive month, and were up only 2.7% from a year ago (full release here). However, in four metros - Tampa, Dallas, San Franciso, and Denver - prices are lower than they were one year ago. For the country as a whole, prices are up only 2.3% from one year ago.

Job Openings and Labor Turnover Survey (JOLTS)

After two consecutive months of solid gains, the number of job openings fell by 275K in June to 7.43 million (full release here). Even with the drop, there are still 422K more job openings than there are unemployed workers.

As I have pointed out before, until job openings fall below the number of unemployed, the US labor market isn’t demand-constrained, and a recession has never started when there were more job openings than unemployed workers.

Unfortunately, the number of new hires plunged 261K, and has now fallen sharply for two consecutive months.

July Employment

And that two-month decline in new hires leads us to the hugely disappointing July employment number that was released this morning (full release here). For the month of July, the economy created only 73K jobs. (The expectation was for 110K.). The unemployment rate ticked up to 4.2%.

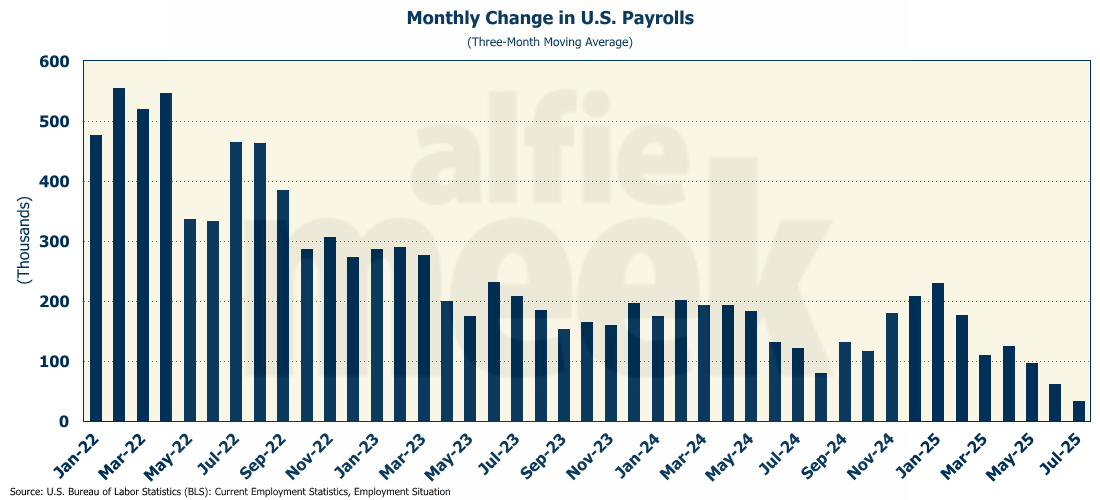

But the more disturbing fact is that both May and June were revised DOWN significantly from the initial reads. The initial May number of 139K is now only 19K. The first June read of 147K is now only 14K! How do you miss by that much? That is more than a quarter of a million jobs that aren’t really there! Those revisions are worse than the Biden-era data revisions. (However, it is more consistent with the new hire data from the JOLTS report of the last two months.) With these revisions, the three-month moving average is clearly trending down, and has been for the entire year.

I said at the time about the May report that if you dig into the data, it was “not a very good report, and will no doubt be revised down in the coming months.” But I had no idea how right I would be.

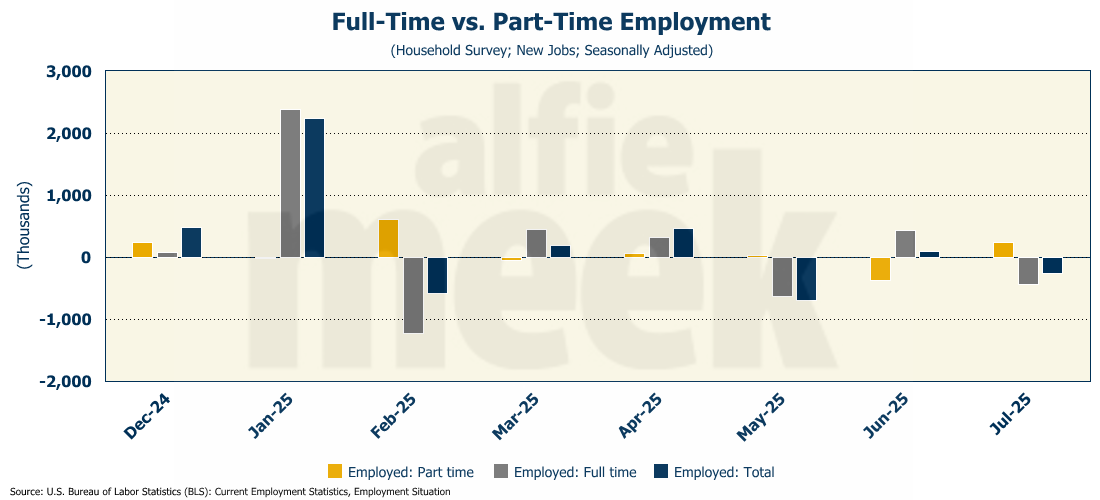

On the household side, household employment was down 260K, with a drop of 440K in full-time jobs and an increase in part-time jobs. I’ve seen this movie before…trading full-time jobs for part-time work. That is not an indicator of a strong labor market.

This utter collapse of the labor market would certainly give the Fed a justifiable reason to cut rates. There is no way they didn’t have some early insight that this number was coming, and yet, they chose not to move. Perhaps Powell just didn’t want to look like he was caving to the President. Pretty big decision to make just to protect your ego.

On the other hand, the markets are rising, the economy is growing (for now), and inflation is moving in the wrong direction. Under those conditions, raising rates makes no sense. In short, the Fed is between a rock and a hard place…but one of their own making. If the August employment number comes in weak, the Fed will cut in September….and inflation will take off. Hold on to your hats, it’s going to be a wild ride.

One More Thing…

On the first post of the month, I like to recognize my gold and silver members. Special thanks to my two “gold” level members Andrew Hajduk and Beth Truelove, with the White County Chamber of Commerce, and my three “silver” level members, Dan McRae, Chuck Fitch, and Greg Whitlock. Their support helps cover the costs associated with putting this together each week.

As the year progresses, I will be moving to a paid-subscription model. However, I am certainly open to a sponsor! If you would be interested in sponsoring this weekly economic update on a monthly, quarterly, bi-annual, or annual basis, please reach out via LinkedIn and let’s discuss further.

If you are simply a regular reader, and find this useful, please consider a membership. I invite you to click/scan the QR code below to join or just “buy a coffee!”