Weekly Economic Update 06-06-25: ISM Manufacturing & Services Surveys; Factory Orders; Consumer Sentiment; and May Employment

Between biased surveys, irrational models, and government lies it is getting really hard to believe any of the economic data.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Sorry this is getting out so late today. If I told you what kind of morning I have had, you simply would not believe a word of it. Frankly, I’m fortunate this is getting out today at all.

As for last week’s post, I don’t know what happened. My best guess is that someone forwarded last week’s post to a lot of people because last Friday’s update set a one-day viewing record, outpacing my previous one-day record by 38%!

Having done this weekly for almost two years, I have learned that I can never predict which posts people will find most interesting. Posts I like the most often don’t do well, and those that I don’t think are all that great take off. It is a mystery.

Something else that is a mystery…the Atlanta Fed’s GDPNow model. You may recall that I ridiculed it mercilessly when it predicted, for no apparent reason, that first quarter GDP would come in at -2.8%. (The actual came in at -0.2%.). At the time, the huge drop in the Atlanta Fed forecast was due to a relatively small, insignificant drop in the ISM manufacturing survey. The day that survey came out, their first quarter GDP forecast plunged. I seriously questioned the rationale behind the model.

In an interesting turn of events, this week, the Atlanta Fed is now forecasting that second quarter GDP will be a positive 4.6%! And guess what drove that huge jump in their forecast? That’s right…a small, insignificant drop in the ISM manufacturing survey (discussed below).

So to be clear…in February, a small drop in the ISM manufacturing index caused the Atlanta Fed model to plunge. In May, a similar drop caused their model to explode. To quote my brother-in-law, “Does the Atlanta Fed just like to look stupid?” It would appear so.

The funny thing is, last week I suggested in my post that the second quarter would likely be in excess of 3%, so strangely enough, the Atlanta Fed may not be far off. I think they are a little strong, but that isn’t the point. The point is that their national economic model seems to be more of a random walk than a rational econometric model. Time will tell.

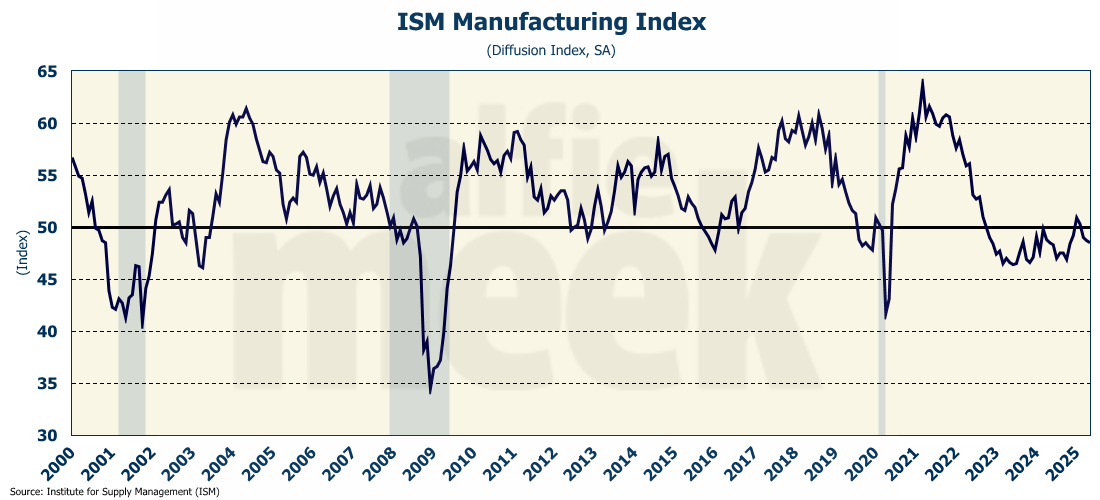

ISM Manufacturing

As I mentioned, the ISM manufacturing survey for May was released on Monday, and it fell slightly from 48.7 to 48.5 (full release here). Again, a negligible drop, but one that triggered the Atlanta Fed to lose their minds.

As has been the case for the last four months, all the sub-indices were below 50 (which indicates a contraction) with the singular exception of “prices paid,” which fell slightly in May, but is still at the highest level it has been since the soaring inflation of 2022.

I’m starting to wonder if the “prices paid” index represents what the purchasing managers are actually paying, or what they expect to be paying, because the inflation data is simply not showing this level of price increases. If these numbers represent what manufacturers are actually paying, then consumers will see some price increases in the near future.

However, as I have explained before, who pays the tariffs is simply a matter of demand elasticity. According to the South China Morning Press, it appears that Chinese firms may end up eating about two-thirds of the tariffs….meaning that U.S. consumers (and producers) may very well not experience the price increases that the media (who know little to nothing about economics) is spending so much time and energy fretting about. Even Goldman Sachs now admits that tariffs won’t trigger a surge in inflation.

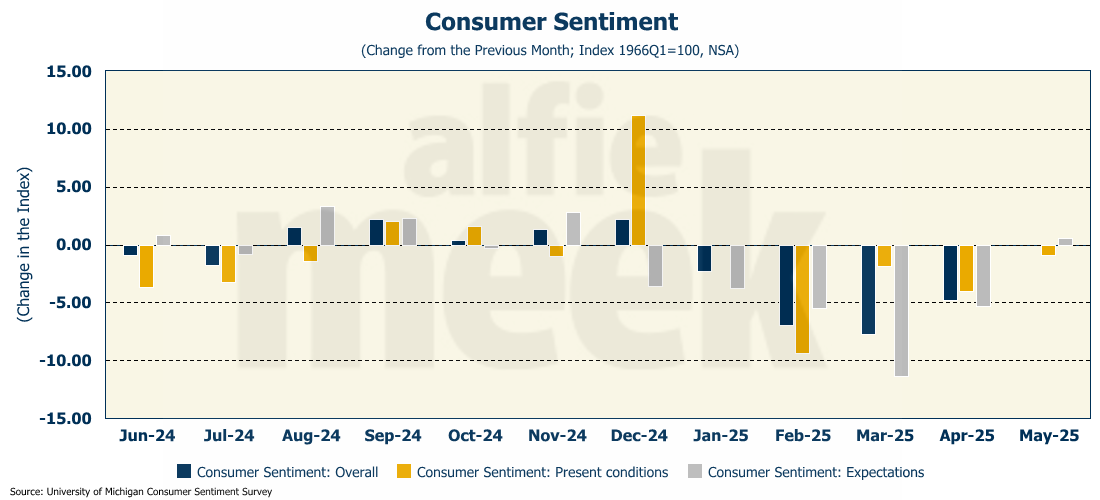

Consumer Sentiment

Speaking of inflation fear-mongering, the University of Michigan released the final numbers for consumer sentiment in May (full release here). For the first time in five months, sentiment didn’t fall…although it didn’t rise either, with the overall level of consumer sentiment remaining steady in May, albeit steady at a very low level. Consumer sentiment about the present economy fell for the fourth consecutive month. However, consumer feelings about the future rose for the first time since November.

As I pointed out in March, the University of Michigan survey has become grossly political. Overall, the survey respondents expect inflation over the next year to be a staggaring 6.6%, and 4.2% over the next 5 years. Both numbers are, or course, patently absurd.

The number is driven by the fact that the survey respondents are heavily weighted toward the left side of the political spectrum, and there is an enormous gap between

Democrat and Republican expectations about future inflation, both of which are highly off base. Democrats expect (or at least say they expect) inflation to be 9.4% one year from now. Republicans, on the other hand, are rosily optimistic and think it will only be around 1% or so. Either that, or they anticipate significant demand destruction in the coming year. (That could actually occur, but I don’t think that is what is driving the Republican inflation outlook.) The 840 basis point difference between the two groups is the largest the gap has ever been, and leads to the conclusion that, at this point, the indicator is practically worthless.

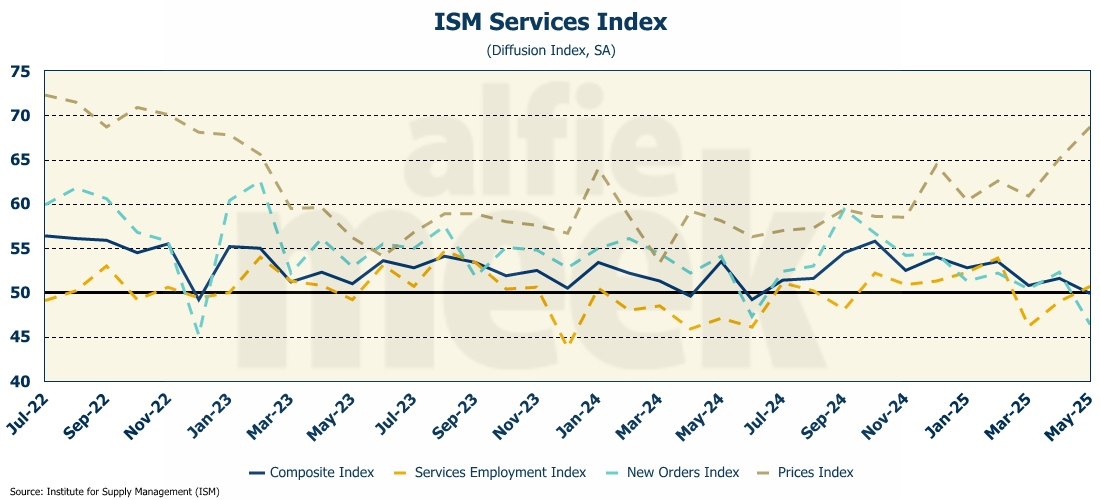

ISM Services

Like the ISM Manufacturing index, the ISM Service index also fell in May, dropping below 50 for the first time since June of last year (full release here). As a reminder, any reading below 50 means that the sector is contracting. Expectations were for a small increase in May.

Surprisingly, the employment sub-index moved above 50, suggesting an increase in service employment. As with manufacturing, the service sector price index is rapidly moving higher, and is now the highest it has been since November 2022.

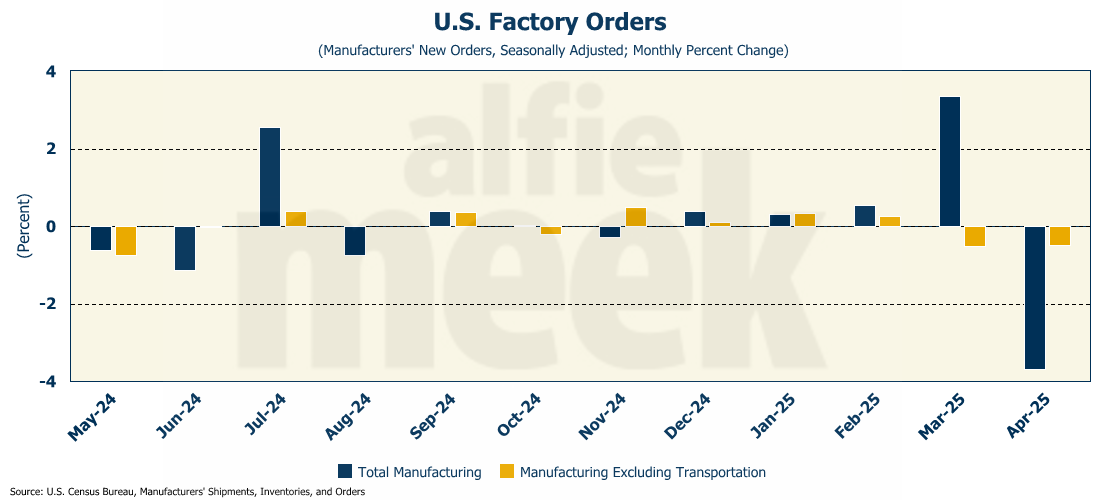

Factory Orders

Factory orders plunged in April, falling 3.7% - the biggest monthly drop since January 2024 (full release here). However, the decline was expected given the tariff “front loading” that occurred in March. So, rather than look at the monthly change, the better metric is the annual change, and even with the threat of tariffs, April orders were 0.9% higher than one year ago.

However, core factory orders (orders less transportation orders) dropped for the second month in a row falling 0.5% - the same rate of decline as they experienced in March. Core orders are actually down 0.1% year over year.

May Employment

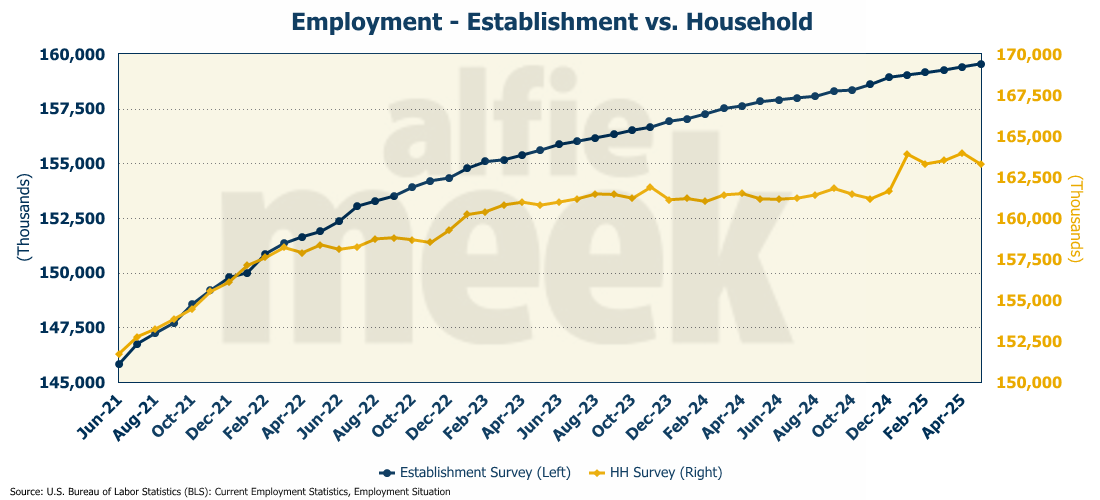

And the big release of the week…May employment, which came in stronger than expected with the economy adding 139K jobs in May, slightly more than was expected (full release here). However, the previous month’s data was revised down by 30K. Further, March was revised down 65K. In fact, every single month of the Trump Administration has been revised lower than the initial estimates. You can change administrations, but some things stay the same and are constant: death, taxes, and the government lying. But even with the revisions, the three-month moving average is moving in the right direction.

Digging into the details, the growth was in healthcare, leisure & hospitality, and social assistance - areas that don’t exactly represent high-paying jobs. Government jobs fell in the month, which isn’t surprising given what has been happening in Washington over the past several weeks. Federal employment fell 22K, and is down 59K since January. Manufacturing lost 8K jobs.

Despite the increase in the establishment payrolls, the household survey showed something quite different. Household employment FELL 696K! That is quite a drop! The drop was completely driven by the loss of full-time jobs, as part-time positions actually rose by 33K.

The media is going to report this jobs report as “good” since they only look at the headline number. But, if you ignore the headline, you see this was actually not a very good report, and will no doubt be revised down in the coming months.

One More Thing…

As usual, in the first post of the month, I would like to recognize my gold and silver members. Special thanks to my two “gold” level members, Andrew Hajduk and Beth Truelove, with the White County Chamber. In addition, I would like to thank my “silver” level members, Dan McRae, Chuck Fitch, and Greg Whitlock. The regular support of these members helps offset the cost of maintaining access to the data providers that allow me to produce this update each week. If you are a regular reader and find this useful, I would ask that you please consider a membership. Just click/scan the QR code below to join or even just “buy a coffee!”